Non-Resident Seller Election To Have Withholding Form 2011

ADVERTISEMENT

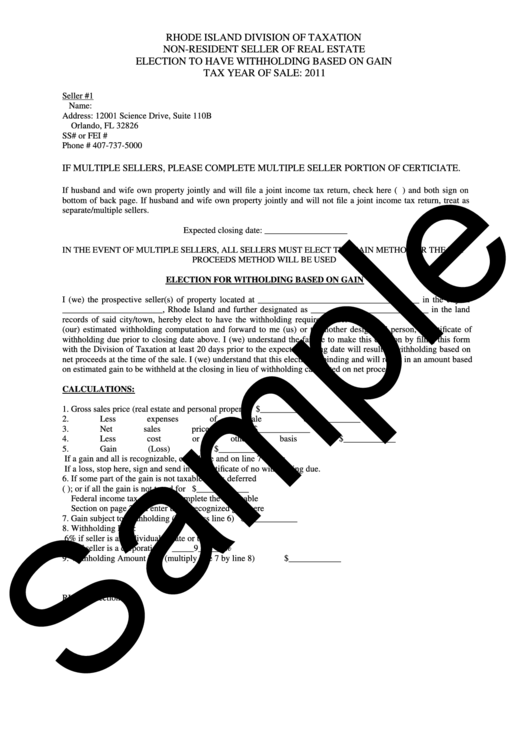

RHODE ISLAND DIVISION OF TAXATION

NON-RESIDENT SELLER OF REAL ESTATE

ELECTION TO HAVE WITHHOLDING BASED ON GAIN

TAX YEAR OF SALE: 2011

Seller #1

Name:

Address: 12001 Science Drive, Suite 110B

Orlando, FL 32826

SS# or FEI #

Phone # 407-737-5000

IF MULTIPLE SELLERS, PLEASE COMPLETE MULTIPLE SELLER PORTION OF CERTICIATE.

If husband and wife own property jointly and will file a joint income tax return, check here ( ) and both sign on

bottom of back page. If husband and wife own property jointly and will not file a joint income tax return, treat as

separate/multiple sellers.

Expected closing date: ___________________

IN THE EVENT OF MULTIPLE SELLERS, ALL SELLERS MUST ELECT THE GAIN METHOD OR THE NET

PROCEEDS METHOD WILL BE USED

ELECTION FOR WITHOLDING BASED ON GAIN

I (we) the prospective seller(s) of property located at _____________________________________ in the city of

_______________________, Rhode Island and further designated as ___________________________ in the land

records of said city/town, hereby elect to have the withholding required under R.I.G.L. 44-30-71.3 based on my

(our) estimated withholding computation and forward to me (us) or to another designated person, a certificate of

withholding due prior to closing date above. I (we) understand the failure to make this election by filing this form

with the Division of Taxation at least 20 days prior to the expected closing date will result in withholding based on

net proceeds at the time of the sale. I (we) understand that this election is binding and will result in an amount based

on estimated gain to be withheld at the closing in lieu of withholding calculated on net proceeds.

CALCULATIONS:

1. Gross sales price (real estate and personal property)

$____________

2. Less expenses of sale

$____________

3. Net sales price

$____________

4. Less cost or other basis

$____________

5. Gain (Loss)

$____________

If a gain and all is recognizable, enter here and on line 7 below

If a loss, stop here, sign and send in for certificate of no withholding due.

6. If some part of the gain is not taxable or tax deferred

(e.g. installment sale); or if all the gain is not taxed for

$____________

Federal income tax purposes, complete the applicable

Section on page 2 and enter the unrecognized gain here

7. Gain subject to Withholding (line 5 less line 6)

$____________

8. Withholding Rate:

6% if seller is an individual, estate or trust

9% if seller is a corporation

_____9______%

9. Withholding Amount Due (multiply line 7 by line 8)

$____________

RI-71.3 Election

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3