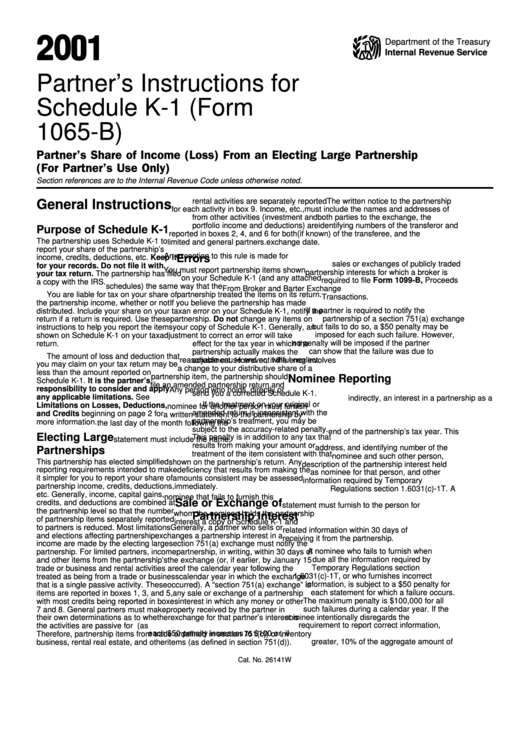

Partner'S Instructions For Schedule K-1 (Form 1065-B) - Partner'S Share Of Income (Loss) From An Electing Large Partnership (For Partner'S Use Only) - 2001

ADVERTISEMENT

01

2 0

Department of the Treasury

Internal Revenue Service

Partner’s Instructions for

Schedule K-1 (Form

1065-B)

Partner’s Share of Income (Loss) From an Electing Large Partnership

(For Partner’s Use Only)

Section references are to the Internal Revenue Code unless otherwise noted.

rental activities are separately reported

The written notice to the partnership

General Instructions

for each activity in box 9. Income, etc.,

must include the names and addresses of

from other activities (investment and

both parties to the exchange, the

portfolio income and deductions) are

identifying numbers of the transferor and

Purpose of Schedule K-1

reported in boxes 2, 4, and 6 for both

(if known) of the transferee, and the

The partnership uses Schedule K-1 to

limited and general partners.

exchange date.

report your share of the partnership’s

An exception to this rule is made for

income, credits, deductions, etc. Keep it

Errors

sales or exchanges of publicly traded

for your records. Do not file it with

You must report partnership items shown

partnership interests for which a broker is

your tax return. The partnership has filed

on your Schedule K-1 (and any attached

required to file Form 1099-B, Proceeds

a copy with the IRS.

schedules) the same way that the

From Broker and Barter Exchange

You are liable for tax on your share of

partnership treated the items on its return.

Transactions.

the partnership income, whether or not

If you believe the partnership has made

If a partner is required to notify the

distributed. Include your share on your tax

an error on your Schedule K-1, notify the

return if a return is required. Use these

partnership of a section 751(a) exchange

partnership. Do not change any items on

but fails to do so, a $50 penalty may be

instructions to help you report the items

your copy of Schedule K-1. Generally, an

imposed for each such failure. However,

shown on Schedule K-1 on your tax

adjustment to correct an error will take

return.

no penalty will be imposed if the partner

effect for the tax year in which the

can show that the failure was due to

partnership actually makes the

The amount of loss and deduction that

reasonable cause and not willful neglect.

adjustment. However, if the error involves

you may claim on your tax return may be

a change to your distributive share of a

less than the amount reported on

partnership item, the partnership should

Nominee Reporting

Schedule K-1. It is the partner’s

file an amended partnership return and

responsibility to consider and apply

Any person who holds, directly or

send you a corrected Schedule K-1.

any applicable limitations. See

indirectly, an interest in a partnership as a

If the treatment on your original or

Limitations on Losses, Deductions,

nominee for another person must furnish

amended return is inconsistent with the

and Credits beginning on page 2 for

a written statement to the partnership by

partnership’s treatment, you may be

more information.

the last day of the month following the

subject to the accuracy-related penalty.

end of the partnership’s tax year. This

Electing Large

This penalty is in addition to any tax that

statement must include the name,

results from making your amount or

address, and identifying number of the

Partnerships

treatment of the item consistent with that

nominee and such other person,

This partnership has elected simplified

shown on the partnership’s return. Any

description of the partnership interest held

reporting requirements intended to make

deficiency that results from making the

as nominee for that person, and other

it simpler for you to report your share of

amounts consistent may be assessed

information required by Temporary

partnership income, credits, deductions,

immediately.

Regulations section 1.6031(c)-1T. A

etc. Generally, income, capital gains,

nominee that fails to furnish this

Sale or Exchange of

credits, and deductions are combined at

statement must furnish to the person for

the partnership level so that the number

whom the nominee holds the partnership

Partnership Interest

of partnership items separately reported

interest a copy of Schedule K-1 and

to partners is reduced. Most limitations

Generally, a partner who sells or

related information within 30 days of

and elections affecting partnership

exchanges a partnership interest in a

receiving it from the partnership.

income are made by the electing large

section 751(a) exchange must notify the

A nominee who fails to furnish when

partnership. For limited partners, income

partnership, in writing, within 30 days of

due all the information required by

and other items from the partnership’s

the exchange (or, if earlier, by January 15

trade or business and rental activities are

of the calendar year following the

Temporary Regulations section

1.6031(c)-1T, or who furnishes incorrect

treated as being from a trade or business

calendar year in which the exchange

information, is subject to a $50 penalty for

that is a single passive activity. These

occurred). A “section 751(a) exchange” is

each statement for which a failure occurs.

items are reported in boxes 1, 3, and 5,

any sale or exchange of a partnership

with most credits being reported in boxes

interest in which any money or other

The maximum penalty is $100,000 for all

such failures during a calendar year. If the

7 and 8. General partners must make

property received by the partner in

nominee intentionally disregards the

their own determinations as to whether

exchange for that partner’s interest is

the activities are passive for them.

attributable to unrealized receivables (as

requirement to report correct information,

each $50 penalty increases to $100 or, if

Therefore, partnership items from trade or

defined in section 751(c)) or inventory

greater, 10% of the aggregate amount of

business, rental real estate, and other

items (as defined in section 751(d)).

Cat. No. 26141W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10