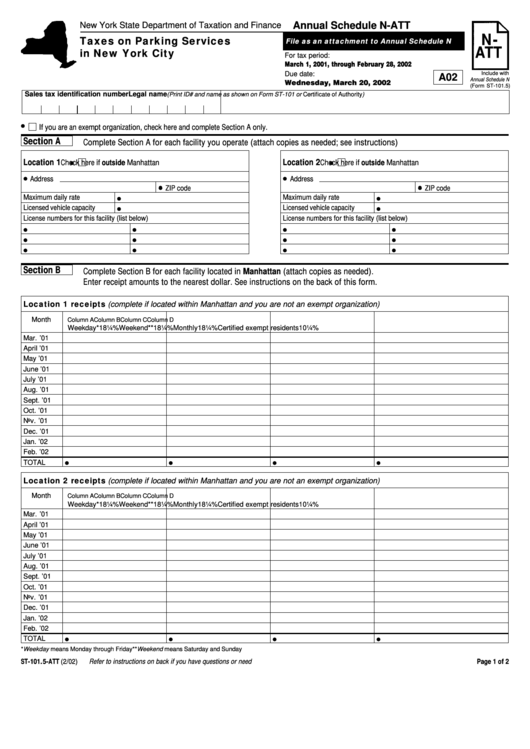

Form St-101.5-Att - Taxes On Parking Services In New York City - New York State Department Of Taxation And Finance

ADVERTISEMENT

Annual Schedule N-ATT

New York State Department of Taxation and Finance

N-

Taxes on Parking Services

File as an attachment to Annual Schedule N

ATT

in New York City

For tax period:

March 1, 2001, through February 28, 2002

Due date:

Include with

A02

Annual Schedule N

Wednesday, March 20, 2002

(Form ST-101.5)

Sales tax identification number

Legal name

(Print ID# and name as shown on Form ST-101 or Certificate of Authority)

If you are an exempt organization, check here and complete Section A only.

Section A

Complete Section A for each facility you operate (attach copies as needed; see instructions)

Location 1

Location 2

Check here if outside Manhattan

Check here if outside Manhattan

Address

Address

ZIP code

ZIP code

Maximum daily rate

Maximum daily rate

Licensed vehicle capacity

Licensed vehicle capacity

License numbers for this facility (list below)

License numbers for this facility (list below)

Section B

Complete Section B for each facility located in Manhattan (attach copies as needed).

Enter receipt amounts to the nearest dollar. See instructions on the back of this form.

Location 1 receipts (complete if located within Manhattan and you are not an exempt organization)

Month

Column A

Column B

Column C

Column D

Weekday* 18¼%

Weekend**

18¼%

Monthly

18¼%

Certified exempt residents

10¼%

Mar. ’01

April ’01

May ’01

June ’01

July ’01

Aug. ’01

Sept. ’01

Oct. ’01

Nov. ’01

Dec. ’01

Jan. ’02

Feb. ’02

TOTAL

Location 2 receipts (complete if located within Manhattan and you are not an exempt organization)

Month

Column A

Column B

Column C

Column D

Weekday* 18¼%

Weekend**

18¼%

Monthly

18¼%

Certified exempt residents

10¼%

Mar. ’01

April ’01

May ’01

June ’01

July ’01

Aug. ’01

Sept. ’01

Oct. ’01

Nov. ’01

Dec. ’01

Jan. ’02

Feb. ’02

TOTAL

*Weekday means Monday through Friday

**Weekend means Saturday and Sunday

ST-101.5-ATT (2/02)

Refer to instructions on back if you have questions or need help.

Please be sure to keep a completed copy for your records.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1