Form Tc201 - Instructions For 2000

ADVERTISEMENT

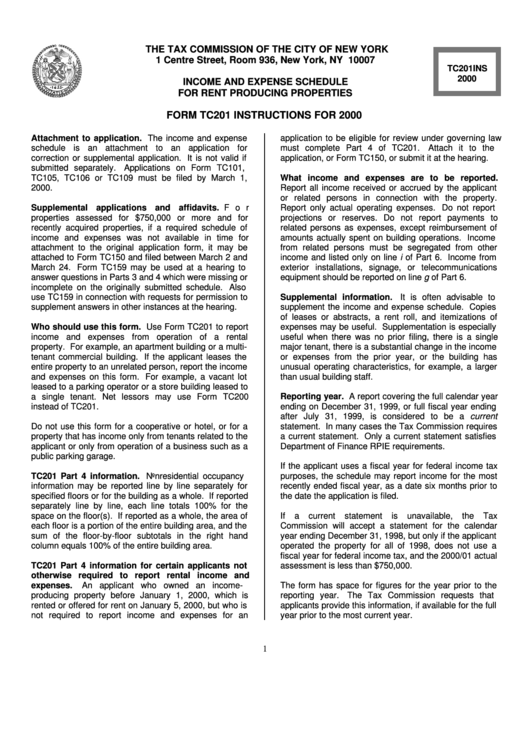

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC201INS

2000

INCOME AND EXPENSE SCHEDULE

FOR RENT PRODUCING PROPERTIES

FORM TC201 INSTRUCTIONS FOR 2000

Attachment to application. The income and expense

application to be eligible for review under governing law

schedule is an attachment to an application for

must complete Part 4 of TC201.

Attach it to the

correction or supplemental application. It is not valid if

application, or Form TC150, or submit it at the hearing.

submitted separately.

Applications on Form TC101,

TC105, TC106 or TC109 must be filed by March 1,

What income and expenses are to be reported.

2000.

Report all income received or accrued by the applicant

or related persons in connection with the property.

Supplemental applications and affidavits.

For

Report only actual operating expenses. Do not report

properties assessed for $750,000 or more and for

projections or reserves. Do not report payments to

recently acquired properties, if a required schedule of

related persons as expenses, except reimbursement of

income and expenses was not available in time for

amounts actually spent on building operations. Income

attachment to the original application form, it may be

from related persons must be segregated from other

attached to Form TC150 and filed between March 2 and

income and listed only on line i of Part 6. Income from

March 24. Form TC159 may be used at a hearing to

exterior installations, signage, or telecommunications

answer questions in Parts 3 and 4 which were missing or

equipment should be reported on line g of Part 6.

incomplete on the originally submitted schedule. Also

use TC159 in connection with requests for permission to

Supplemental information.

It is often advisable to

supplement answers in other instances at the hearing.

supplement the income and expense schedule. Copies

of leases or abstracts, a rent roll, and itemizations of

Who should use this form. Use Form TC201 to report

expenses may be useful. Supplementation is especially

income and expenses from operation of a rental

useful when there was no prior filing, there is a single

property. For example, an apartment building or a multi-

major tenant, there is a substantial change in the income

tenant commercial building. If the applicant leases the

or expenses from the prior year, or the building has

entire property to an unrelated person, report the income

unusual operating characteristics, for example, a larger

and expenses on this form. For example, a vacant lot

than usual building staff.

leased to a parking operator or a store building leased to

a single tenant. Net lessors may use Form TC200

Reporting year. A report covering the full calendar year

instead of TC201.

ending on December 31, 1999, or full fiscal year ending

after July 31, 1999, is considered to be a current

Do not use this form for a cooperative or hotel, or for a

statement. In many cases the Tax Commission requires

property that has income only from tenants related to the

a current statement. Only a current statement satisfies

applicant or only from operation of a business such as a

Department of Finance RPIE requirements.

public parking garage.

If the applicant uses a fiscal year for federal income tax

TC201 Part 4 information. Nonresidential occupancy

purposes, the schedule may report income for the most

information may be reported line by line separately for

recently ended fiscal year, as a date six months prior to

specified floors or for the building as a whole. If reported

the date the application is filed.

separately line by line, each line totals 100% for the

space on the floor(s). If reported as a whole, the area of

If

a

current

statement

is

unavailable,

the

Tax

each floor is a portion of the entire building area, and the

Commission will accept a statement for the calendar

sum of the floor-by-floor subtotals in the right hand

year ending December 31, 1998, but only if the applicant

column equals 100% of the entire building area.

operated the property for all of 1998, does not use a

fiscal year for federal income tax, and the 2000/01 actual

TC201 Part 4 information for certain applicants not

assessment is less than $750,000.

otherwise required to report rental income and

expenses.

An applicant who owned an income-

The form has space for figures for the year prior to the

producing property before January 1, 2000, which is

reporting year.

The Tax Commission requests that

rented or offered for rent on January 5, 2000, but who is

applicants provide this information, if available for the full

year prior to the most current year.

not required to report income and expenses for an

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2