Net Profits License Fee Return Form - Woodland County Fiscal Court - Kentucky

ADVERTISEMENT

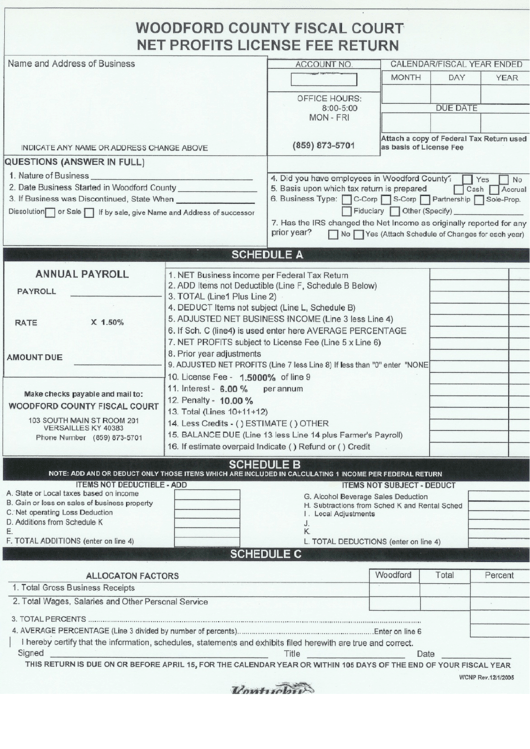

WOODFORD COUNTY FISCAL COURT

NET PROFITS LICENSE FEE RETURN

Name and Address of Business

ACCOUNT NO.

CALENDAR/FISCAL YEAR ENDED

I

MONTH

I

OAY

I

YEAR

DUE DATE

I

I

[

c

OFFICE HOURS:

8:00-5:00

MON - FRI

INDICATE ANY NAME OR ADDRESS CHANGE ABOVE

QUESTIONS

(ANSWER

IN FULL)

(859) 873-5701

Attach a copy of Federal Tax Return used

as basis of License Fee

1. Nature of Business -

2. Date Business Started in Woodford County

3. IfBusiness was Discontinued, State When

DissolutionD

or Sale

D

If by sale, give Name and Address

of successor

4. Did you have employees in Woodford County'!

DYes

D No

5. Basis upon which tax return is prepared

D

Cash

D

Accrual

6. Business Type: DC-Corp D S-CorpD PartnershipD Sole-Prop.

D Fiduciary D Other(Specify)

7. Has the IRS changed the Net Income as originally reported for any

prioryear?

D

No

D

Yes (AttachScheduleof Changesfor eachyear)

SCHEDULE

A

ANNUAL PAYROLL

PAYROLL

RATE

X 1.50%

AMOUNT DUE

Make checks payable and mail to:

WOODFORD

COUNTY FISCAL COURT

103 SOUTH MAIN ST ROOM 201

VERSAILLES KY 40383

Phone Number

(859) 873-5701

1. NET Business income per Federal Tax Return

2. ADD Items not Deductible (Line F, Schedule B Below)

3. TOTAL (Line1 Plus Line 2)

4. DEDUCT Items not subject (Line L, Schedule B)

5. ADJUSTED NET BUSINESS 1NCOME (Line 3 less Line 4)

6. If Sch. C (line4) is used enter here AVERAGE PERCENTAGE

7. NET PROFITS subject to License Fee (Line 5 x Line 6)

8. Prior year adjustments

9. ADJUSTEDNETPROFITS(Line7 less Line8) If lessthan "0" enter "NONE

10. License Fee - 1.5000%

of line 9

11. Interest - 6.00 %

per annum

12. Penalty - 10.00 %

13. Total (Lines 10+11+12)

14. Less Credits - () ESTIMATE () OTHER

15. BALANCE DUE (Line 13 less Line 14 plus Farmer's Payroll)

16. If estimate overpaid Indicate () Refund or () Credit

SCHEDULE

B

NOTE:

ADD AND OR DEDUCT

ONLY THOSE

ITEMS WHICH ARE INCLUDED

IN CALCULATING

1 INCOME PER FEDERAL

RETURN

ITEMSNOTDEDUCTIBLE

-

ADD

A. State or Local taxes based on income

B. Gain or loss on sales of business property

C:Net operating Loss Deduction

D. Additions from Schedule K

E.

F. TOTAL ADDITIONS (enter on line 4)

ITEMS NOT SUBJECT

-

DEDUCT

G. Alcohol Beverage Sales Deduction

H. Subtractions from Sched K and Rental Sched

I. Local Adjustments

J.

K.

L. TOTAL DEDUCTIONS (enter on line 4)

n. ._-~._-----

n-

.

.-

.

SCHEDULE C

I hereby certify that the information, schedules, statements and exhibits filed herewith are true and correct.

Signed

Title

Date

THISRETURNIS DUEON OR BEFORE APRIL 15, FORTHE CALENDAR YEAR OR WITHIN105DAYSOF THE ENDOFYOURFISCALYEAR

WCNP

Rev.1211/2005

~

'/""""'~

S

"'~"

.. .

,

""""""

,

'

,'iIIL

.

""

.

"'

..

"""'

,

'

.

.

"

.

f'"

..

'"'-":'

.

'

.

~

",.v---6T."f"

7'..rc--.",

ALLOCA TON FACTORS

Woodford

Total

Percent

1. Total Gross Business Receipts

2. Total Wages, Salaries and Other Personal Service

3. TOTALPERCENTS.... . ........... " """""""""'...........................................................................................................". . ...........

'

4. AVERAGEPERCENTAGE (Line3 dividedby numberof percents)................................................................Enter

on line6

i

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1