Return Of Income Tax Withheld Form

ADVERTISEMENT

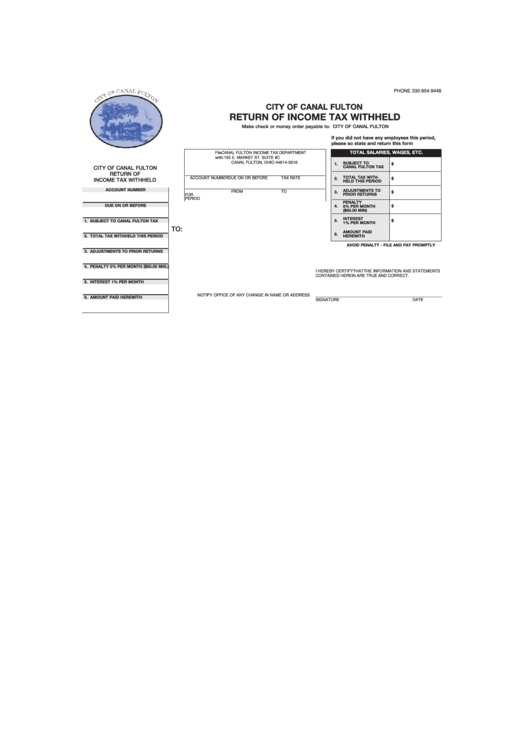

PHONE 330-854-9448

CITY OF CANAL FULTON

RETURN OF INCOME TAX WITHHELD

Make check or money order payable to: CITY OF CANAL FULTON

If you did not have any employees this period,

please so state and return this form

TOTAL SALARIES, WAGES, ETC.

File

CANAL FULTON INCOME TAX DEPARTMENT

with:

155 E. MARKET ST. SUITE #C

CANAL FULTON, OHIO 44614-0516

SUBJECT TO

1.

$

CANAL FULTON TAX

CITY OF CANAL FULTON

RETURN OF

TOTAL TAX WITH-

ACCOUNT NUMBER

DUE ON OR BEFORE

TAX RATE

2.

$

INCOME TAX WITHHELD

HELD THIS PERIOD

ACCOUNT NUMBER

ADJUSTMENTS TO

FROM

TO

3.

$

PRIOR RETURNS

FOR

PERIOD

PENALTY

DUE ON OR BEFORE

4.

$

5% PER MONTH

($50.00 MIN)

INTEREST

5.

$

1. SUBJECT TO CANAL FULTON TAX

1% PER MONTH

TO:

AMOUNT PAID

6.

2. TOTAL TAX WITHHELD THIS PERIOD

HEREWITH

AVOID PENALTY - FILE AND PAY PROMPTLY

3. ADJUSTMENTS TO PRIOR RETURNS

4. PENALTY 5% PER MONTH ($50.00 MIN.)

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS

CONTAINED HEREIN ARE TRUE AND CORRECT.

5. INTEREST 1% PER MONTH

NOTIFY OFFICE OF ANY CHANGE IN NAME OR ADDRESS

________________________________________________________

6. AMOUNT PAID HEREWITH

SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1