Form Dbpr Abt-6002 - Examination Application For Multiple License Locations Page 12

ADVERTISEMENT

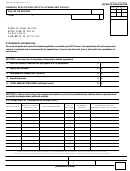

SECTION 13 – SALES TAX

TO BE COMPLETED BY THE DEPARTMENT OF REVENUE

Trade Name (D/B/A)

The named applicant for a license/permit has complied with the Florida Statutes concerning registration for

Sales and Use Tax.

1. This is to verify that the current owner as named in this application has filed all returns and that all

outstanding billings and returns appear to have been paid through the period ending

__________________ or the liability has been acknowledged and agreed to be paid by the

applicant. This verification does not constitute a certificate as contained in Section 212.10 (1), F.S.

(Not applicable if no transfer involved).

2. Furthermore, the named applicant for an Alcoholic Beverage License has complied with Florida

Statutes concerning registration for Sales and Use Tax, and has paid any applicable taxes due.

Signed____________________________________________________Date_____________________

Title______________________________________________________

Department of Revenue Stamp:

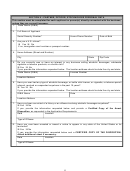

SECTION 14 – ZONING

TO BE COMPLETED BY THE ZONING AUTHORITY GOVERNING YOUR BUSINESS LOCATION

Trade Name (D/B/A)

Street Address

City

County

State

Zip Code

Are there outside areas which are contiguous to the premises which are to be part of the premises sought to

be licensed?”

Yes

No

If this application is for issuance of an alcoholic beverage license where zoning approval is required, the

zoning authority must complete “A” and “B”. If zoning is not required, the applicant must complete section

“B”.

A. The location complies with zoning requirements for the sale of alcoholic beverages or wholesale

tobacco products pursuant to this application for a Series______________ license.

Signed____________________________________________________Date_____________________

Title______________________________________________________

B. Is the location within limits of an “Incorporated City or Town”?

Yes

No

If yes, enter the name of the city or town:___________________________________________

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13