Form Dr 309634 - Local Government User Of Diesel Fuel Tax Return

ADVERTISEMENT

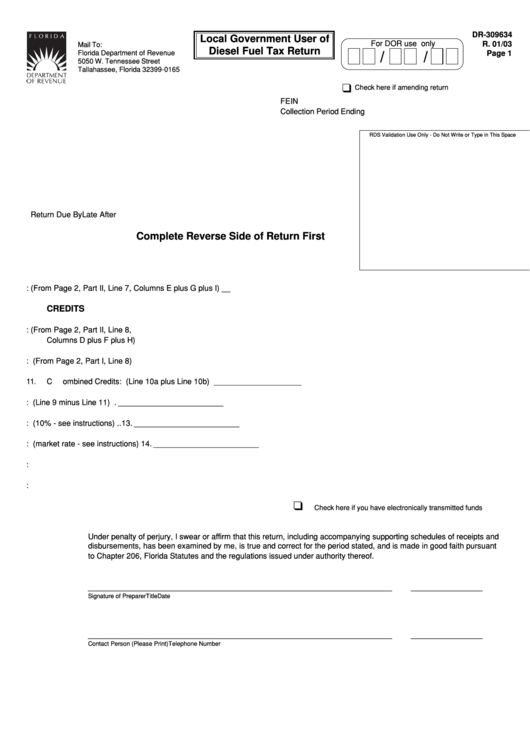

DR-309634

Local Government User of

For DOR use only

R. 01/03

Mail To:

Diesel Fuel Tax Return

Florida Department of Revenue

Page 1

/

/

5050 W. Tennessee Street

Tallahassee, Florida 32399-0165

❑

Check here if amending return

FEIN

Collection Period Ending

RDS Validation Use Only - Do Not Write or Type in This Space

Return Due By

Late After

Complete Reverse Side of Return First

9.

Diesel Fuel Tax Due: (From Page 2, Part II, Line 7, Columns E plus G plus I) ......................... 9. ________________________

CREDITS

10a. Diesel Fuel Tax Credit: (From Page 2, Part II, Line 8,

Columns D plus F plus H) ...................................................................

10a. _____________________

10b. Gasoline Tax Credit: (From Page 2, Part I, Line 8) ............................ 10b. _____________________

11.

Combined Credits: (Line 10a plus Line 10b) .......................................................................... 11. ________________________

12.

Net Tax Due: (Line 9 minus Line 11) ...................................................................................... 12. ________________________

13.

Penalty: (10% - see instructions) ............................................................................................ 13. ________________________

14.

Interest: (market rate - see instructions) ................................................................................. 14. ________________________

15.

Total Due with Return: ............................................................................................................. 15. ________________________

16.

Amount to be Refunded: .......................................................................................................... 16. ________________________

❑

Check here if you have electronically transmitted funds

Under penalty of perjury, I swear or affirm that this return, including accompanying supporting schedules of receipts and

disbursements, has been examined by me, is true and correct for the period stated, and is made in good faith pursuant

to Chapter 206, Florida Statutes and the regulations issued under authority thereof.

________________________________________________________________

_______________

Signature of Preparer

Title

Date

________________________________________________________________

_______________

Contact Person (Please Print)

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6