Form Boe-38-I -2005 - Application For In-State Voluntary Disclosure - Board Of Equalization State Of California

ADVERTISEMENT

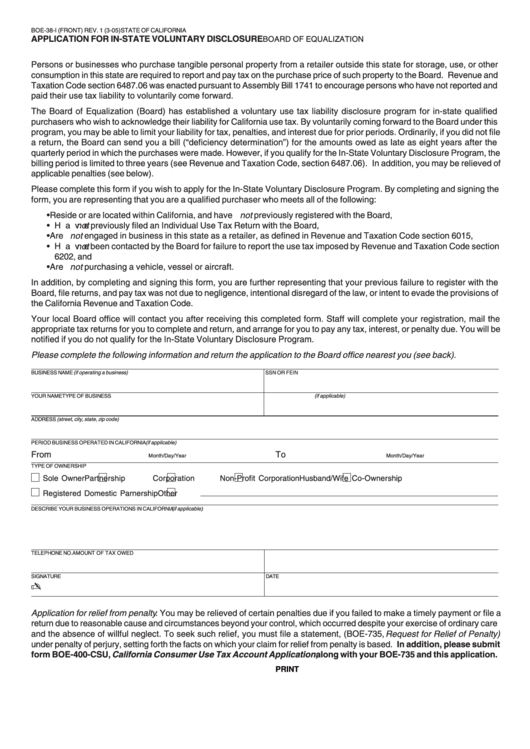

BOE-38-I (FRONT) REV. 1 (3-05)

STATE OF CALIFORNIA

APPLICATION FOR IN-STATE VOLUNTARY DISCLOSURE

BOARD OF EQUALIZATION

Persons or businesses who purchase tangible personal property from a retailer outside this state for storage, use, or other

consumption in this state are required to report and pay tax on the purchase price of such property to the Board. Revenue and

Taxation Code section 6487.06 was enacted pursuant to Assembly Bill 1741 to encourage persons who have not reported and

paid their use tax liability to voluntarily come forward.

The Board of Equalization (Board) has established a voluntary use tax liability disclosure program for in-state qualified

purchasers who wish to acknowledge their liability for California use tax. By voluntarily coming forward to the Board under this

program, you may be able to limit your liability for tax, penalties, and interest due for prior periods. Ordinarily, if you did not file

a return, the Board can send you a bill (“deficiency determination”) for the amounts owed as late as eight years after the

quarterly period in which the purchases were made. However, if you qualify for the In-State Voluntary Disclosure Program, the

billing period is limited to three years (see Revenue and Taxation Code, section 6487.06). In addition, you may be relieved of

applicable penalties (see below).

Please complete this form if you wish to apply for the In-State Voluntary Disclosure Program. By completing and signing the

form, you are representing that you are a qualified purchaser who meets all of the following:

• Reside or are located within California, and have not previously registered with the Board,

• Have not previously filed an Individual Use Tax Return with the Board,

• Are not engaged in business in this state as a retailer, as defined in Revenue and Taxation Code section 6015,

• Have not been contacted by the Board for failure to report the use tax imposed by Revenue and Taxation Code section

6202, and

• Are not purchasing a vehicle, vessel or aircraft.

In addition, by completing and signing this form, you are further representing that your previous failure to register with the

Board, file returns, and pay tax was not due to negligence, intentional disregard of the law, or intent to evade the provisions of

the California Revenue and Taxation Code.

Your local Board office will contact you after receiving this completed form. Staff will complete your registration, mail the

appropriate tax returns for you to complete and return, and arrange for you to pay any tax, interest, or penalty due. You will be

notified if you do not qualify for the In-State Voluntary Disclosure Program.

Please complete the following information and return the application to the Board office nearest you (see back).

BUSINESS NAME (if operating a business)

SSN OR FEIN

YOUR NAME

TYPE OF BUSINESS (if applicable)

ADDRESS (street, city, state, zip code)

PERIOD BUSINESS OPERATED IN CALIFORNIA (if applicable)

From

To

Month/Day/Year

Month/Day/Year

TYPE OF OWNERSHIP

Sole Owner

Partnership

Corporation

Non-Profit Corporation

Husband/Wife Co-Ownership

Registered Domestic Parnership

Other

DESCRIBE YOUR BUSINESS OPERATIONS IN CALIFORNIA (if applicable) :

TELEPHONE NO.

AMOUNT OF TAX OWED

SIGNATURE

DATE

✍

Application for relief from penalty : You may be relieved of certain penalties due if you failed to make a timely payment or file a

return due to reasonable cause and circumstances beyond your control, which occurred despite your exercise of ordinary care

and the absence of willful neglect. To seek such relief, you must file a statement, (BOE-735, Request for Relief of Penalty)

under penalty of perjury, setting forth the facts on which your claim for relief from penalty is based. In addition, please submit

form BOE-400-CSU, California Consumer Use Tax Account Application, along with your BOE-735 and this application.

CLEAR

PRINT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1