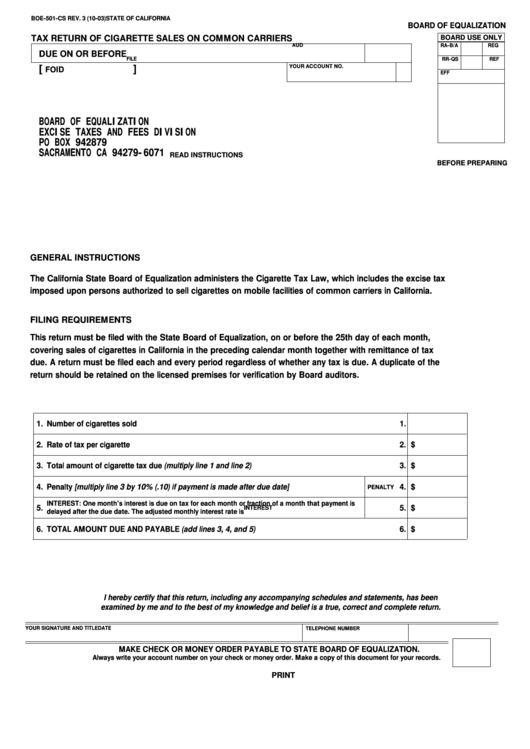

BOE-501-CS REV. 3 (10-03)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

TAX RETURN OF CIGARETTE SALES ON COMMON CARRIERS

BOARD USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

FILE

RR-QS

REF

[

]

YOUR ACCOUNT NO.

FOID

EFF

BOARD OF EQUALIZATION

EXCISE TAXES AND FEES DIVISION

PO BOX 942879

SACRAMENTO CA 94279-6071

READ INSTRUCTIONS

BEFORE PREPARING

GENERAL INSTRUCTIONS

The California State Board of Equalization administers the Cigarette Tax Law, which includes the excise tax

imposed upon persons authorized to sell cigarettes on mobile facilities of common carriers in California.

FILING REQUIREMENTS

This return must be filed with the State Board of Equalization, on or before the 25th day of each month,

covering sales of cigarettes in California in the preceding calendar month together with remittance of tax

due. A return must be filed each and every period regardless of whether any tax is due. A duplicate of the

return should be retained on the licensed premises for verification by Board auditors.

1.

Number of cigarettes sold

1.

$

2.

Rate of tax per cigarette

2.

3.

Total amount of cigarette tax due (multiply line 1 and line 2)

3.

$

4.

Penalty [multiply line 3 by 10% (.10) if payment is made after due date]

4.

$

PENALTY

INTEREST: One month's interest is due on tax for each month or fraction of a month that payment is

5.

5.

$

INTEREST

delayed after the due date. The adjusted monthly interest rate is

6.

TOTAL AMOUNT DUE AND PAYABLE (add lines 3, 4, and 5)

6.

$

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct and complete return.

YOUR SIGNATURE AND TITLE

TELEPHONE NUMBER

DATE

MAKE CHECK OR MONEY ORDER PAYABLE TO STATE BOARD OF EQUALIZATION.

Always write your account number on your check or money order. Make a copy of this document for your records.

CLEAR

PRINT

1

1