Form As-22 - Refund Request For Tax Year

ADVERTISEMENT

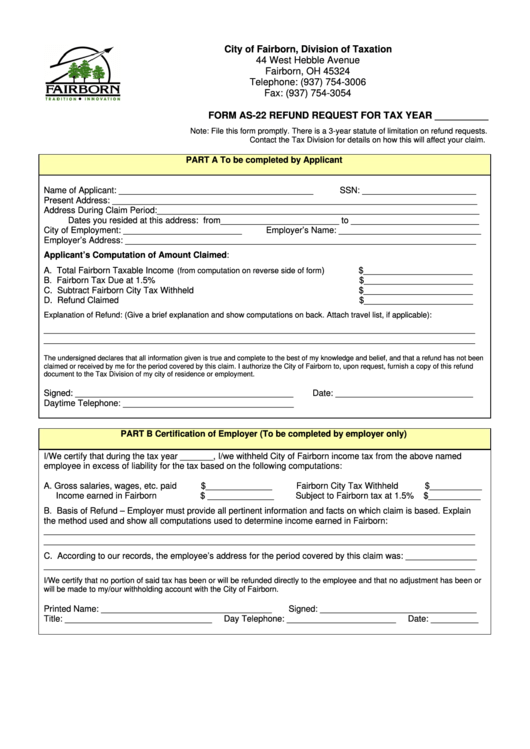

City of Fairborn, Division of Taxation

44 West Hebble Avenue

Fairborn, OH 45324

Telephone: (937) 754-3006

Fax: (937) 754-3054

FORM AS-22 REFUND REQUEST FOR TAX YEAR __________

Note: File this form promptly. There is a 3-year statute of limitation on refund requests.

Contact the Tax Division for details on how this will affect your claim.

PART A To be completed by Applicant

Name of Applicant: _________________________________________

SSN: ________________________

Present Address: _____________________________________________________________________________

Address During Claim Period:____________________________________________________________________

Dates you resided at this address: from_________________________ to ___________________________

City of Employment: _________________________

Employer’s Name: ______________________________

Employer’s Address: __________________________________________________________________________

Applicant’s Computation of Amount Claimed:

A. Total Fairborn Taxable Income

)

$_______________________

(from computation on reverse side of form

B. Fairborn Tax Due at 1.5%

$_______________________

C. Subtract Fairborn City Tax Withheld

$_______________________

D. Refund Claimed

$_______________________

Explanation of Refund: (Give a brief explanation and show computations on back. Attach travel list, if applicable):

___________________________________________________________________________________________

___________________________________________________________________________________________

The undersigned declares that all information given is true and complete to the best of my knowledge and belief, and that a refund has not been

claimed or received by me for the period covered by this claim. I authorize the City of Fairborn to, upon request, furnish a copy of this refund

document to the Tax Division of my city of residence or employment.

Signed: ______________________________________________

Date: _____________________________

Daytime Telephone: ____________________________________

PART B Certification of Employer (To be completed by employer only)

I/We certify that during the tax year _______, I/we withheld City of Fairborn income tax from the above named

employee in excess of liability for the tax based on the following computations:

A. Gross salaries, wages, etc. paid

$______________

Fairborn City Tax Withheld

$___________

Income earned in Fairborn

$ ______________

Subject to Fairborn tax at 1.5%

$___________

B. Basis of Refund – Employer must provide all pertinent information and facts on which claim is based. Explain

the method used and show all computations used to determine income earned in Fairborn:

___________________________________________________________________________________________

___________________________________________________________________________________________

C. According to our records, the employee’s address for the period covered by this claim was: _______________

___________________________________________________________________________________________

I/We certify that no portion of said tax has been or will be refunded directly to the employee and that no adjustment has been or

will be made to my/our withholding account with the City of Fairborn.

Printed Name: ____________________________________

Signed: _________________________________

Title: _______________________________

Day Telephone: _______________________

Date: __________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1