Statement To Amend Contribution And Wage Report Form

ADVERTISEMENT

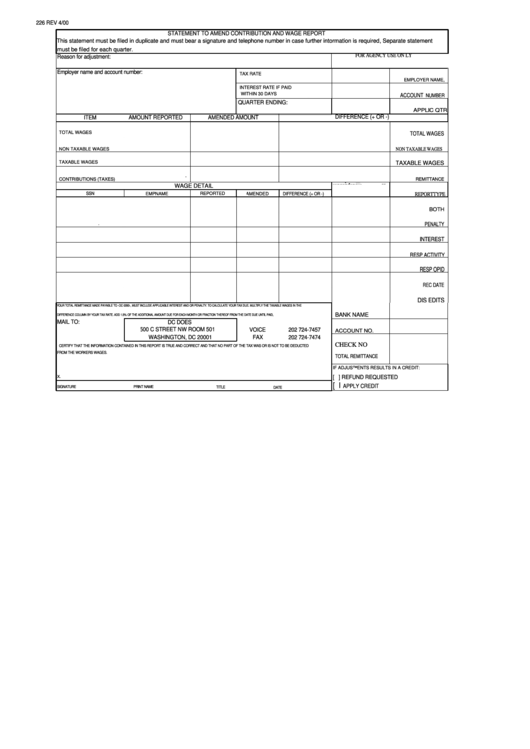

226 REV 4/00

STATEMENT TO AMEND CONTRIBUTION AND WAGE REPORT

This statement must be filed in duplicate and must bear a signature and telephone number in case further intormation is required, Separate statement

must be filed for each quarter.

FOR AGENCY USE ON LY

Reason for adjustment:

Employer name and account number:

TAX RATE

EMPLOYER NAME,

INTEREST RATE IF PAID

WITHIN 30 DAYS

ACCOUNT

NUMBER

QUARTER ENDING:

APPLIC QTR

DIFFERENCE (+ OR -)

ITEM

AMOUNT REPORTED

AMENDED AMOUNT

TOTAL WAGES

TOTAL WAGES

NON TAXABLE WAGES

NON TAXABLE WAGES

TAXABLE WAGES

TAXABLE WAGES

.

.

CONTRIBUTIONS (TAXES)

REMITTANCE

.

.

WAGE DETAIL

.

.

SSN

EMPNAME

REPORTED

AMENDED

DIFFERENCE (+ OR -)

REPORTTYPE

BOTH

.

PENALTY

INTEREST

RESP ACTIVITY

RESP OPID

REC DATE

DIS EDITS

YOUR TOTAL REMITTANCE MADE PAYABLE TO -OC 0093-, MUST INCLUDE APPLICABLE INTEREST AND OR PENALTY. TO CALCULATE YOUR TAX DUE. MULTIPLY THE TAXABLE WAGES IN THE

BANK NAME

DIFFERENCE COLUMN BY YOUR TAX RATE. ADD 1.5% OF THE ADDITIONAL AMOUNT DUE FOR EACH MONTH OR FRACTION THEREOF FROM THE DATE DUE UNTIL PAID,

MAIL TO:

DC DOES

500 C STREET NW ROOM 501

VOICE

202 724-7457

ACCOUNT NO.

WASHINGTON, DC 20001

FAX

202 724-7474

CHECK NO

CERTIFY THAT THE INFORMATION CONTAINED IN THIS REPORT IS TRUE AND CORRECT AND THAT NO PART OF THE TAX WAS OR IS NOT TO BE DEDUCTED

FROM THE WORKERS WAGES.

TOTAL REMITTANCE

IF ADJUSTMENTS RESULTS IN A CREDIT:

X.

[ ] REFUND REQUESTED

[ I

APPLY CREDIT

SIGNATURE

PRINT NAME

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1