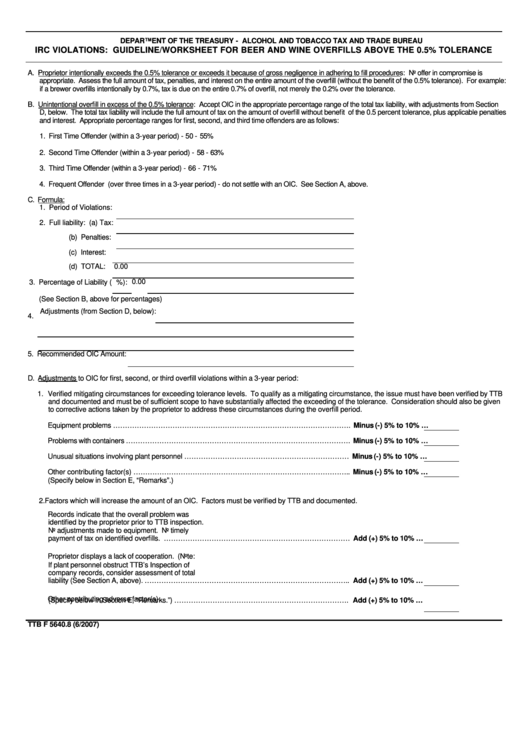

DEPARTMENT OF THE TREASURY - ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

IRC VIOLATIONS: GUIDELINE/WORKSHEET FOR BEER AND WINE OVERFILLS ABOVE THE 0.5% TOLERANCE

A. Proprietor intentionally exceeds the 0.5% tolerance or exceeds it because of gross negligence in adhering to fill procedures: No offer in compromise is

appropriate. Assess the full amount of tax, penalties, and interest on the entire amount of the overfill (without the benefit of the 0.5% tolerance). For example:

if a brewer overfills intentionally by 0.7%, tax is due on the entire 0.7% of overfill, not merely the 0.2% over the tolerance.

B. Unintentional overfill in excess of the 0.5% tolerance: Accept OIC in the appropriate percentage range of the total tax liability, with adjustments from Section

D, below. The total tax liability will include the full amount of tax on the amount of overfill without benefit of the 0.5 percent tolerance, plus applicable penalties

and interest. Appropriate percentage ranges for first, second, and third time offenders are as follows:

1. First Time Offender (within a 3-year period) - 50 - 55%

2. Second Time Offender (within a 3-year period) - 58 - 63%

3. Third Time Offender (within a 3-year period) - 66 - 71%

4. Frequent Offender (over three times in a 3-year period) - do not settle with an OIC. See Section A, above.

C. Formula:

1. Period of Violations:

2. Full liability: (a) Tax:

(b) Penalties:

(c) Interest:

(d) TOTAL:

0.00

%): 0.00

3. Percentage of Liability (

(See Section B, above for percentages)

4. Adjustments (from Section D, below):

5. Recommended OIC Amount:

D. Adjustments to OIC for first, second, or third overfill violations within a 3-year period:

1. Verified mitigating circumstances for exceeding tolerance levels. To qualify as a mitigating circumstance, the issue must have been verified by TTB

and documented and must be of sufficient scope to have substantially affected the exceeding of the tolerance. Consideration should also be given

to corrective actions taken by the proprietor to address these circumstances during the overfill period.

Equipment problems ………………………………………………………………………………………. Minus (-) 5% to 10% …

Problems with containers …………………………………………………………………………………. Minus (-) 5% to 10% …

Unusual situations involving plant personnel …………………………………………………………… Minus (-) 5% to 10% …

Other contributing factor(s) ……………………………………………………………………………….. Minus (-) 5% to 10% …

(Specify below in Section E, “Remarks”.)

2. Factors which will increase the amount of an OIC. Factors must be verified by TTB and documented.

Records indicate that the overall problem was

identified by the proprietor prior to TTB inspection.

No adjustments made to equipment. No timely

payment of tax on identified overfills. …………………………………………………………………… Add (+) 5% to 10% …

Proprietor displays a lack of cooperation. (Note:

If plant personnel obstruct TTB’s Inspection of

company records, consider assessment of total

liability (See Section A, above). ………………………………………………………………………….. Add (+) 5% to 10% …

Other contributing adverse factor(s).

(Specify below in Section E, “Remarks.”) ………………………………………………………………. Add (+) 5% to 10% …

TTB F 5640.8 (6/2007)

1

1 2

2