Form Hcp-Est - Health Care Provider Tax Estimate Payment Voucher Form

ADVERTISEMENT

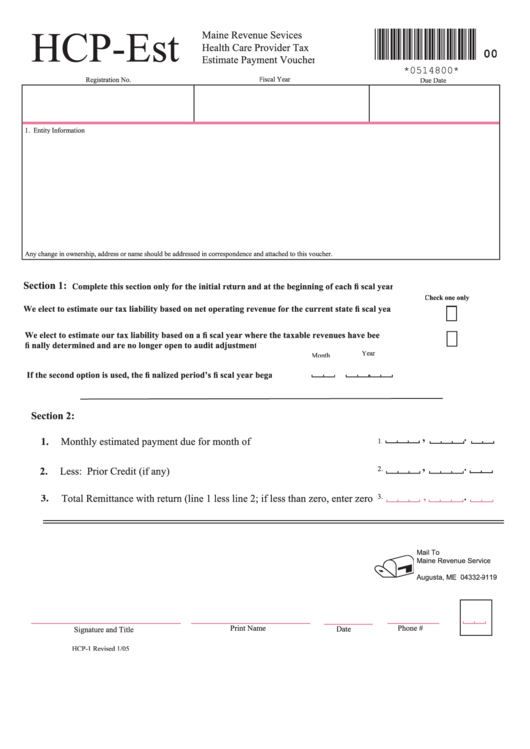

HCP-Est

Maine Revenue Sevices

Health Care Provider Tax

00

Estimate Payment Voucher

*0514800*

Fiscal Year

Registration No.

Due Date

1. Entity Information

Any change in ownership, address or name should be addressed in correspondence and attached to this voucher.

Section 1:

Complete this section only for the initial return and at the beginning of each fi scal year.

Check one only

We elect to estimate our tax liability based on net operating revenue for the current state fi scal year.

We elect to estimate our tax liability based on a fi scal year where the taxable revenues have been

fi nally determined and are no longer open to audit adjustment.

Year

Month

If the second option is used, the fi nalized period’s fi scal year began

Section 2:

,

.

1.

Monthly estimated payment due for month of

1.

,

.

2.

2.

Less: Prior Credit (if any)

,

.

3.

Total Remittance with return (line 1 less line 2; if less than zero, enter zero

3.

Mail To:

Maine Revenue Service

P.O. Box 9119

Augusta, ME 04332-9119

Print Name

Phone #

Date

Signature and Title

HCP-1 Revised 1/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1