Form R-1 - Conveyance Tax Return Form

ADVERTISEMENT

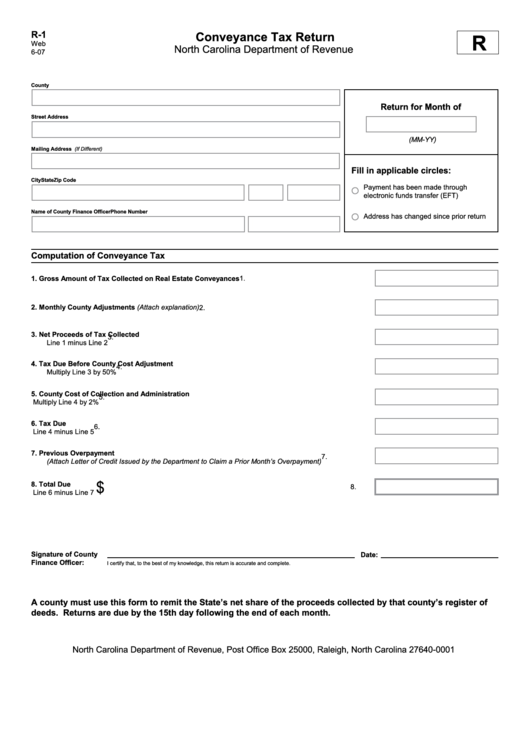

R-1

Conveyance Tax Return

R

Web

North Carolina Department of Revenue

6-07

County

Return for Month of

Street Address

(MM-YY)

Mailing Address (If Different)

Fill in applicable circles:

City

State

Zip Code

Payment has been made through

electronic funds transfer (EFT)

Name of County Finance Officer

Phone Number

Address has changed since prior return

Computation of Conveyance Tax

1.

Gross Amount of Tax Collected on Real Estate Conveyances

1.

2.

Monthly County Adjustments (Attach explanation)

2.

3.

Net Proceeds of Tax Collected

3.

Line 1 minus Line 2

4.

Tax Due Before County Cost Adjustment

4.

Multiply Line 3 by 50%

5.

County Cost of Collection and Administration

5.

Multiply Line 4 by 2%

6.

Tax Due

6.

Line 4 minus Line 5

7.

Previous Overpayment

7.

(Attach Letter of Credit Issued by the Department to Claim a Prior Month’s Overpayment)

$

8.

Total Due

8.

Line 6 minus Line 7

Signature of County

Date:

Finance Officer:

I certify that, to the best of my knowledge, this return is accurate and complete.

A county must use this form to remit the State’s net share of the proceeds collected by that county’s register of

deeds. Returns are due by the 15th day following the end of each month.

North Carolina Department of Revenue, Post Office Box 25000, Raleigh, North Carolina 27640-0001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1