Form 21d - Computation Of Due Payment Form

ADVERTISEMENT

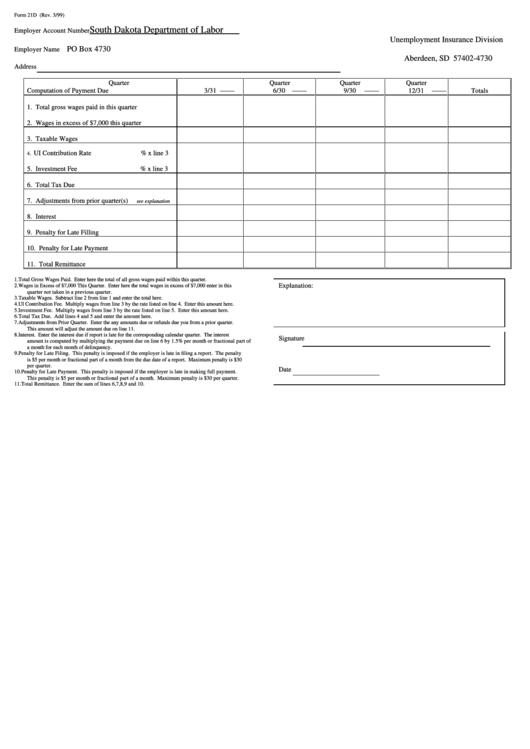

Form 21D (Rev. 3/99)

South Dakota Department of Labor

Employer Account Number

Unemployment Insurance Division

PO Box 4730

Employer Name

Aberdeen, SD 57402-4730

Address

Quarter

Quarter

Quarter

Quarter

Computation of Payment Due

3/31

6/30

9/30

12/31

Totals

1. Total gross wages paid in this quarter

2. Wages in excess of $7,000 this quarter

3. Taxable Wages

UI Contribution Rate

% x line 3

4.

5. Investment Fee

% x line 3

6. Total Tax Due

7. Adjustments from prior quarter(s)

see explanation

8. Interest

9. Penalty for Late Filling

10. Penalty for Late Payment

11. Total Remittance

1.

Total Gross Wages Paid. Enter here the total of all gross wages paid within this quarter.

Explanation:

2.

Wages in Excess of $7,000 This Quarter. Enter here the total wages in excess of $7,000 enter in this

quarter not taken in a previous quarter.

3.

Taxable Wages. Subtract line 2 from line 1 and enter the total here.

4.

UI Contribution Fee. Multiply wages from line 3 by the rate listed on line 4. Enter this amount here.

5.

Investment Fee. Multiply wages from line 3 by the rate listed on line 5. Enter this amount here.

6.

Total Tax Due. Add lines 4 and 5 and enter the amount here.

7.

Adjustments from Prior Quarter. Enter the any amounts due or refunds due you from a prior quarter.

This amount will adjust the amount due on line 11.

8.

Interest. Enter the interest due if report is late for the corresponding calendar quarter. The interest

Signature

amount is computed by multiplying the payment due on line 6 by 1.5% per month or fractional part of

a month for each month of delinquency.

9.

Penalty for Late Filing. This penalty is imposed if the employer is late in filing a report. The penalty

is $5 per month or fractional part of a month from the due date of a report. Maximum penalty is $30

per quarter.

Date

10. Penalty for Late Payment. This penalty is imposed if the employer is late in making full payment.

This penalty is $5 per month or fractional part of a month. Maximum penalty is $30 per quarter.

11. Total Remittance. Enter the sum of lines 6,7,8,9 and 10.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1