Wyoming Employer'S Notice Of Change Form

ADVERTISEMENT

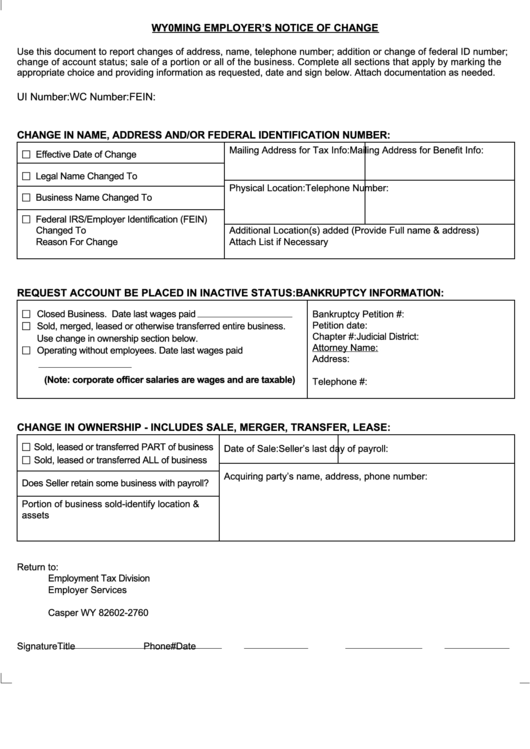

WY0MING EMPLOYER’S NOTICE OF CHANGE

Use this document to report changes of address, name, telephone number; addition or change of federal ID number;

change of account status; sale of a portion or all of the business. Complete all sections that apply by marking the

appropriate choice and providing information as requested, date and sign below. Attach documentation as needed.

UI Number:

WC Number:

FEIN:

CHANGE IN NAME, ADDRESS AND/OR FEDERAL IDENTIFICATION NUMBER:

Mailing Address for Tax Info:

Mailing Address for Benefit Info:

n

Effective Date of Change

n

Legal Name Changed To

Physical Location:

Telephone Number:

n

Business Name Changed To

n

Federal IRS/Employer Identification (FEIN)

Changed To

Additional Location(s) added (Provide Full name & address)

Reason For Change

Attach List if Necessary

REQUEST ACCOUNT BE PLACED IN INACTIVE STATUS:

BANKRUPTCY INFORMATION:

n

Closed Business. Date last wages paid

Bankruptcy Petition #:

Petition date:

n

Sold, merged, leased or otherwise transferred entire business.

Chapter #:

Judicial District:

Use change in ownership section below.

Attorney Name:

n

Operating without employees. Date last wages paid

Address:

(Note: corporate officer salaries are wages and are taxable)

Telephone #:

CHANGE IN OWNERSHIP - INCLUDES SALE, MERGER, TRANSFER, LEASE:

n

Sold, leased or transferred PART of business

Date of Sale:

Seller’s last day of payroll:

n

Sold, leased or transferred ALL of business

Acquiring party’s name, address, phone number:

Does Seller retain some business with payroll?

Portion of business sold-identify location &

assets

Return to:

Employment Tax Division

Employer Services

P.O. Box 2760

Casper WY 82602-2760

Signature

Title

Phone#

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1