Form Rw-1 - Montana Mineral Royalty Withholding Tax Payment Voucher

ADVERTISEMENT

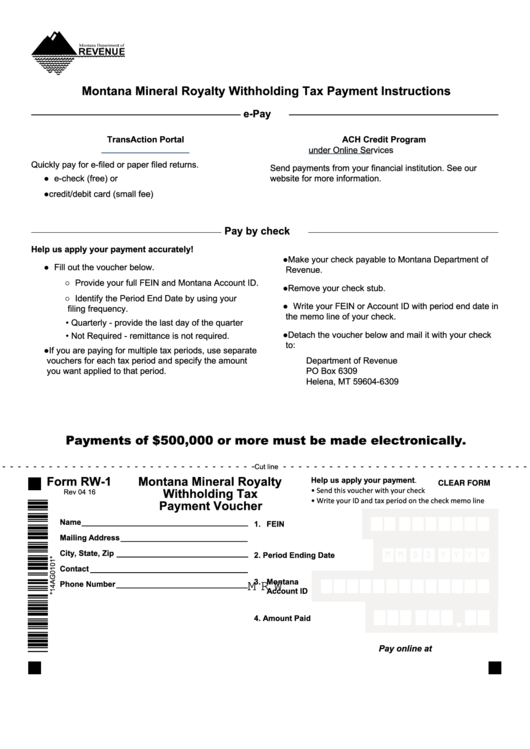

Montana Mineral Royalty Withholding Tax Payment Instructions

e-Pay

TransAction Portal

ACH Credit Program

https://tap.dor.mt.gov

revenue.mt.gov

under Online Services

Quickly pay for e-filed or paper filed returns.

Send payments from your financial institution. See our

● e-check (free) or

website for more information.

● credit/debit card (small fee)

Pay by check

Help us apply your payment accurately!

● Make your check payable to Montana Department of

● Fill out the voucher below.

Revenue.

○ Provide your full FEIN and Montana Account ID.

● Remove your check stub.

○ Identify the Period End Date by using your

● Write your FEIN or Account ID with period end date in

filing frequency.

the memo line of your check.

• Quarterly - provide the last day of the quarter

● Detach the voucher below and mail it with your check

• Not Required - remittance is not required.

to:

● If you are paying for multiple tax periods, use separate

vouchers for each tax period and specify the amount

Department of Revenue

you want applied to that period.

PO Box 6309

Helena, MT 59604-6309

Payments of $500,000 or more must be made electronically.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Cut line

Form RW-1

Montana Mineral Royalty

Help us apply your payment.

CLEAR FORM

• Send this voucher with your check

Withholding Tax

Rev 04 16

• Write your ID and tax period on the check memo line

Payment Voucher

Name ______________________________________

1. FEIN

Mailing Address _____________________________

City, State, Zip ______________________________

M M D D Y Y Y Y

2. Period Ending Date

Contact ____________________________________

3. Montana

M R W

Phone Number ______________________________

Account ID

.

4. Amount Paid

Pay online at revenue.mt.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1