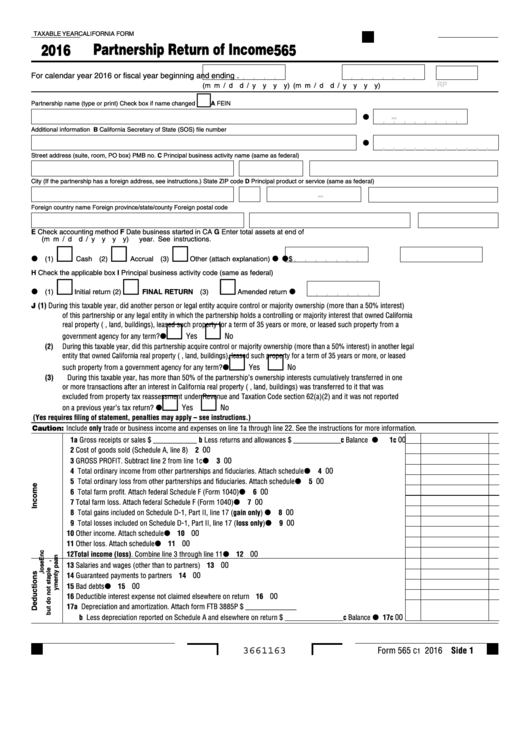

TAXABLE YEAR

CALIFORNIA FORM

Partnership Return of Income

2016

565

For calendar year 2016 or fiscal year beginning

and ending

.

RP

(m m / d d / y y y y)

(m m / d d / y y y y)

Partnership name (type or print) Check box if name changed

A FEIN

Additional information

B California Secretary of State (SOS) file number

C Principal business activity name (same as federal)

Street address (suite, room, PO box)

PMB no.

City (If the partnership has a foreign address, see instructions.)

State

ZIP code

D Principal product or service (same as federal)

Foreign country name

Foreign province/state/county

Foreign postal code

E Check accounting method

F Date business started in CA

G

Enter total assets at end of

(m m / d d / y y y y)

year. See instructions.

$

(1)

Cash (2)

Accrual (3)

Other (attach explanation)

H Check the applicable box

I

Principal business activity code (same as federal)

FINAL RETURN (3)

(1)

Initial return (2)

Amended return

(1)

During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest)

J

of this partnership or any legal entity in which the partnership holds a controlling or majority interest that owned California

real property (i .e ., land, buildings), leased such property for a term of 35 years or more, or leased such property from a

Yes

No

government agency for any term? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)

During this taxable year, did this partnership acquire control or majority ownership (more than a 50% interest) in another legal

entity that owned California real property (i .e ., land, buildings), leased such property for a term of 35 years or more, or leased

Yes

No

such property from a government agency for any term? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)

During this taxable year, has more than 50% of the partnership’s ownership interests cumulatively transferred in one

or more transactions after an interest in California real property (i .e ., land, buildings) was transferred to it that was

excluded from property tax reassessment under Revenue and Taxation Code section 62(a)(2) and it was not reported

Yes

No

on a previous year’s tax return? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Yes requires filing of statement, penalties may apply – see instructions.)

Caution: Include only trade or business income and expenses on line 1a through line 22 . See the instructions for more information .

00

1 a Gross receipts or sales $ ____________ b Less returns and allowances $ _____________ . . . . . c Balance

1c

00

2 Cost of goods sold (Schedule A, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 GROSS PROFIT . Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Total ordinary income from other partnerships and fiduciaries . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Total ordinary loss from other partnerships and fiduciaries . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Total farm profit . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

,

,

00

7 Total farm loss . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

00

8 Total gains included on Schedule D-1, Part II, line 17 (gain only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Total losses included on Schedule D-1, Part II, line 17 (loss only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

,

,

00

10 Other income . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

.

00

11 Other loss . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Total income (loss) . Combine line 3 through line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13 Salaries and wages (other than to partners) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

15 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

16 Deductible interest expense not claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 a Depreciation and amortization . Attach form FTB 3885P $ ______________

00

b Less depreciation reported on Schedule A and elsewhere on return $ ________________ . . . . . c Balance

17c

Form 565

2016 Side 1

3661163

C1

1

1 2

2 3

3 4

4 5

5