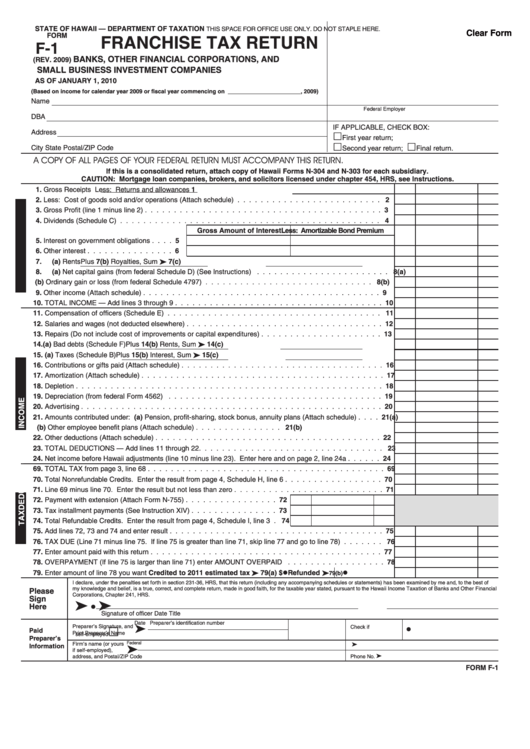

STATE OF HAWAII — DEPARTMENT OF TAXATION

THIS SPACE FOR OFFICE USE ONLY. DO NOT STAPLE HERE.

Clear Form

FORM

FRANCHISE TAX RETURN

F-1

BANKS, OTHER FINANCIAL CORPORATIONS, AND

(REV. 2009)

SMALL BUSINESS INVESTMENT COMPANIES

AS OF JANUARY 1, 2010

(Based on income for calendar year 2009 or fiscal year commencing on _______________________ , 2009)

Name

Federal Employer I.D. No.

DBA

IF APPLICABLE, CHECK BOX:

Address

First year return;

City

State

Postal/ZIP Code

Second year return;

Final return.

A COPY OF ALL PAGES OF YOUR FEDERAL RETURN MUST ACCOMPANY THIS RETURN.

If this is a consolidated return, attach copy of Hawaii Forms N-304 and N-303 for each subsidiary.

CAUTION: Mortgage loan companies, brokers, and solicitors licensed under chapter 454, HRS, see Instructions.

1.

1

Gross Receipts

Less: Returns and allowances

2.

2

Less: Cost of goods sold and/or operations (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . .

3.

3

Gross Profit (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

4

Dividends (Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross Amount of Interest

Less: Amortizable Bond Premium

5.

5

Interest on government obligations . . . .

6.

6

Other interest . . . . . . . . . . . . . . .

7.

(a) Rents

Plus 7(b) Royalties

7(c)

, Sum

8.

(a) Net capital gains (from federal Schedule D) (See Instructions) . . . . . . . . . . . . . . . . . . . . . . .

8(a)

(b) Ordinary gain or loss (from federal Schedule 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8(b)

9.

9

Other income (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

10

TOTAL INCOME — Add lines 3 through 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

11

Compensation of officers (Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

12

Salaries and wages (not deducted elsewhere) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

13

Repairs (Do not include cost of improvements or capital expenditures) . . . . . . . . . . . . . . . . . . . . .

14.

(a) Bad debts (Schedule F)

Plus 14(b) Rents

14(c)

, Sum

15.

(a) Taxes (Schedule B)

Plus 15(b) Interest

15(c)

, Sum

16.

16

Contributions or gifts paid (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

17

Amortization (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.

18

Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.

19

Depreciation (from federal Form 4562) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20.

20

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.

(a) Pension, profit-sharing, stock bonus, annuity plans (Attach schedule) . . . .

21(a)

Amounts contributed under:

(b) Other employee benefit plans (Attach schedule) . . . . . . . . . . . . . . .

21(b)

22.

22

Other deductions (Attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23.

23

TOTAL DEDUCTIONS — Add lines 11 through 22. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24.

24

Net income before Hawaii adjustments (line 10 minus line 23). Enter here and on page 2, line 24a . . . . . .

69.

69

TOTAL TAX from page 3, line 68 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

70.

70

Total Nonrefundable Credits. Enter the result from page 4, Schedule H, line 6 . . . . . . . . . . . . . . . . .

71.

71

Line 69 minus line 70. Enter the result but not less than zero . . . . . . . . . . . . . . . . . . . . . . . . . .

72.

72

Payment with extension (Attach Form N-755) . . . . . . . . . . . . . . . .

73.

73

Tax installment payments (See Instruction XIV) . . . . . . . . . . . . . . .

74.

74

Total Refundable Credits. Enter the result from page 4, Schedule I, line 3 .

75.

75

Add lines 72, 73 and 74 and enter result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

76.

76

TAX DUE (Line 71 minus line 75. If line 75 is greater than line 71, skip line 77 and go to line 78) . . . . . . .

77.

77

Enter amount paid with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

78.

78

OVERPAYMENT (If line 75 is larger than line 71) enter AMOUNT OVERPAID . . . . . . . . . . . . . . . . .

79.

Enter amount of line 78 you want Credited to 2011 estimated tax 79(a) $

Refunded 79(b)

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of

Please

my knowledge and belief, is a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Taxation of Banks and Other Financial

Corporations, Chapter 241, HRS.

Sign

Here

Signature of officer

Date

Title

Date

Preparer’s identification number

Preparer’s Signature, and

Paid

Check if

Print Preparer’s Name

self-employed

Preparer’s

Information

Federal

Firm’s name (or yours

E.I. No.

if self-employed),

Phone No.

address, and Postal/ZIP Code

FORM F-1

1

1 2

2 3

3 4

4