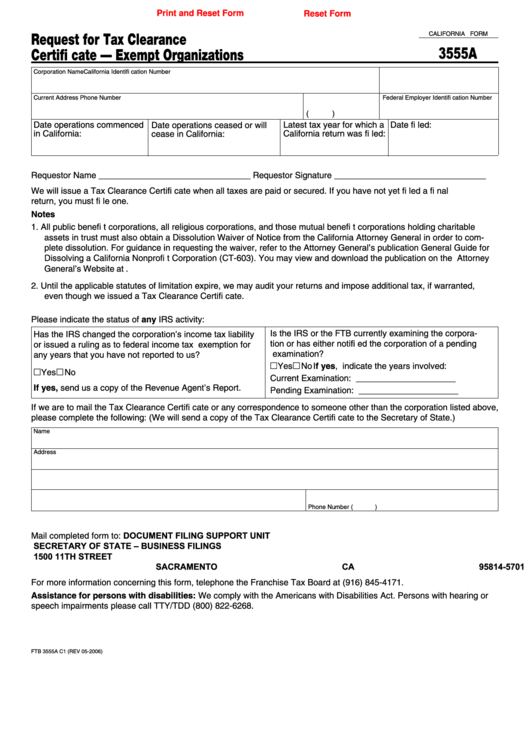

Print and Reset Form

Reset Form

CALIFORNIA FORM

Request for Tax Clearance

3555A

Certifi cate — Exempt Organizations

Corporation Name

California Identifi cation Number

Current Address

Phone Number

Federal Employer Identifi cation Number

(

)

Date operations commenced

Date operations ceased or will

Latest tax year for which a

Date fi led:

in California:

cease in California:

California return was fi led:

Requestor Name ________________________________ Requestor Signature ________________________________

We will issue a Tax Clearance Certifi cate when all taxes are paid or secured. If you have not yet fi led a fi nal

return, you must fi le one.

Notes

1. All public benefi t corporations, all religious corporations, and those mutual benefi t corporations holding charitable

assets in trust must also obtain a Dissolution Waiver of Notice from the California Attorney General in order to com-

plete dissolution. For guidance in requesting the waiver, refer to the Attorney General’s publication General Guide for

Dissolving a California Nonprofi t Corporation (CT-603). You may view and download the publication on the Attorney

General’s Website at

2. Until the applicable statutes of limitation expire, we may audit your returns and impose additional tax, if warranted,

even though we issued a Tax Clearance Certifi cate.

Please indicate the status of any IRS activity:

Is the IRS or the FTB currently examining the corpora-

Has the IRS changed the corporation’s income tax liability

tion or has either notifi ed the corporation of a pending

or issued a ruling as to federal income tax exemption for

examination?

any years that you have not reported to us?

Yes

No If yes, indicate the years involved:

Yes

No

Current Examination:

_____________________

If yes, send us a copy of the Revenue Agent’s Report.

Pending Examination:

_____________________

If we are to mail the Tax Clearance Certifi cate or any correspondence to someone other than the corporation listed above,

please complete the following: (We will send a copy of the Tax Clearance Certifi cate to the Secretary of State.)

Name

Address

Phone Number (

)

Mail completed form to:

DOCUMENT FILING SUPPORT UNIT

SECRETARY OF STATE – BUSINESS FILINGS

1500 11TH STREET

SACRAMENTO CA 95814-5701

For more information concerning this form, telephone the Franchise Tax Board at (916) 845-4171.

Assistance for persons with disabilities: We comply with the Americans with Disabilities Act. Persons with hearing or

speech impairments please call TTY/TDD (800) 822-6268.

FTB 3555A C1 (REV 05-2006)

1

1