Form 04-522.2 - Inventory Report - Cigarette And Tobacco Products Tax - State Of Alaska - Department Of Revenue

ADVERTISEMENT

Cigarette and Tobacco Products Tax

State of Alaska

Department of Revenue

Inventory Report

Tax Division

PO Box 110420

Juneau, AK 99811-0420

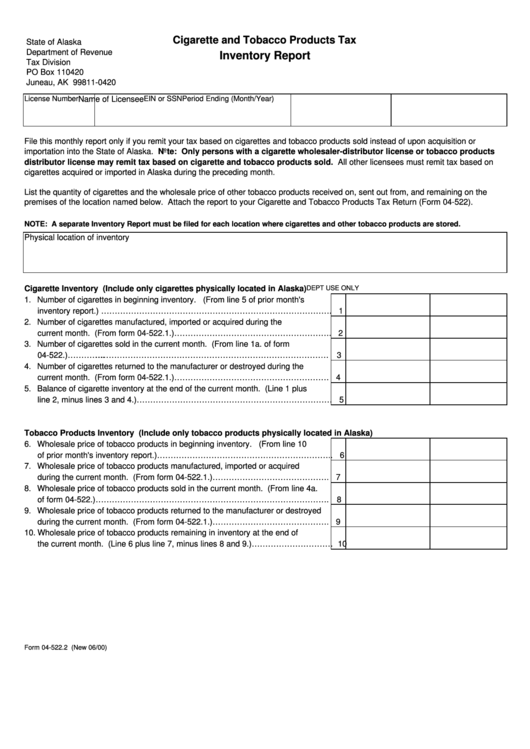

License Number

EIN or SSN

Period Ending (Month/Year)

Name of Licensee

File this monthly report only if you remit your tax based on cigarettes and tobacco products sold instead of upon acquisition or

importation into the State of Alaska. Note: Only persons with a cigarette wholesaler-distributor license or tobacco products

distributor license may remit tax based on cigarette and tobacco products sold. All other licensees must remit tax based on

cigarettes acquired or imported in Alaska during the preceding month.

List the quantity of cigarettes and the wholesale price of other tobacco products received on, sent out from, and remaining on the

premises of the location named below. Attach the report to your Cigarette and Tobacco Products Tax Return (Form 04-522).

NOTE: A separate Inventory Report must be filed for each location where cigarettes and other tobacco products are stored.

Physical location of inventory

Cigarette Inventory (Include only cigarettes physically located in Alaska)

DEPT USE ONLY

1. Number of cigarettes in beginning inventory. (From line 5 of prior month's

inventory report.) …………………………………………………………………………. 1

2. Number of cigarettes manufactured, imported or acquired during the

current month. (From form 04-522.1.)…………………………………………………. 2

3. Number of cigarettes sold in the current month. (From line 1a. of form

04-522.)…………..

……………………………………………………………………………………………… 3

4. Number of cigarettes returned to the manufacturer or destroyed during the

current month. (From form 04-522.1.) ………………………………………………… 4

5. Balance of cigarette inventory at the end of the current month. (Line 1 plus

line 2, minus lines 3 and 4.)……………………………………………………………… 5

Tobacco Products Inventory (Include only tobacco products physically located in Alaska)

6. Wholesale price of tobacco products in beginning inventory. (From line 10

of prior month's inventory report.)……………………………………………………….. 6

7. Wholesale price of tobacco products manufactured, imported or acquired

during the current month. (From form 04-522.1.) ……………………………………. 7

8. Wholesale price of tobacco products sold in the current month. (From line 4a.

of form 04-522.) …………………………………………………………………………….. 8

9. Wholesale price of tobacco products returned to the manufacturer or destroyed

during the current month. (From form 04-522.1.) ……………………………………. 9

10. Wholesale price of tobacco products remaining in inventory at the end of

the current month. (Line 6 plus line 7, minus lines 8 and 9.)………………………… 10

Form 04-522.2 (New 06/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1