Form Bt - 4 - Bw - Monthly Report Of Custom Bonded Warehouses Form - Department Of Revenue Services, Connecticut

ADVERTISEMENT

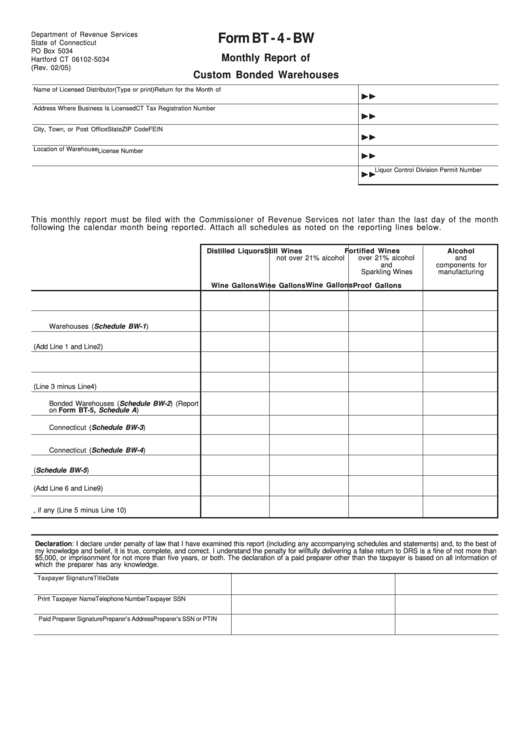

Department of Revenue Services

Form BT - 4 - BW

State of Connecticut

PO Box 5034

Monthly Report of

Hartford CT 06102-5034

(Rev. 02/05)

Custom Bonded Warehouses

Name of Licensed Distributor (Type or print)

Return for the Month of

Address Where Business Is Licensed

CT Tax Registration Number

City, Town, or Post Office

State

ZIP Code

FEIN

Location of Warehouse

License Number

Liquor Control Division Permit Number

This monthly report must be filed with the Commissioner of Revenue Services not later than the last day of the month

following the calendar month being reported. Attach all schedules as noted on the reporting lines below.

Distilled Liquors

Still Wines

Fortified Wines

Alcohol

not over 21% alcohol

over 21% alcohol

and

and

components for

Sparkling Wines

manufacturing

Wine Gallons

Proof Gallons

Wine Gallons

Wine Gallons

1.

Inventory in Bond at the Beginning of the Month

2.

Total of Merchandise Placed in Custom Bonded

Warehouses (Schedule BW-1) .........................

3.

Total (Add Line 1 and Line 2) ...............................

4.

Inventory in Bond at the End of the Month ...........

5.

Accountable Balance (Line 3 minus Line 4) ........

6.

Total Merchandise Withdrawn From Custom

Bonded Warehouses (Schedule BW-2) (Report

on Form BT-5, Schedule A) .............................

7.

Total Merchandise Transferred in Bond Outside

Connecticut (Schedule BW-3) ..........................

8.

Total Merchandise Transferred in Bond Inside

Connecticut (Schedule BW-4)

9.

Total Adjustment (Schedule BW-5) ....................

10. Total (Add Line 6 and Line 9) ...............................

11. Difference, if any (Line 5 minus Line 10)

Declaration: I declare under penalty of law that I have examined this report (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of

which the preparer has any knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Taxpayer SSN

Paid Preparer Signature

Preparer’s Address

Preparer’s SSN or PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1