Form Lhtc - Livable Home Tax Credit Program (Lhtc) Application - 2016

ADVERTISEMENT

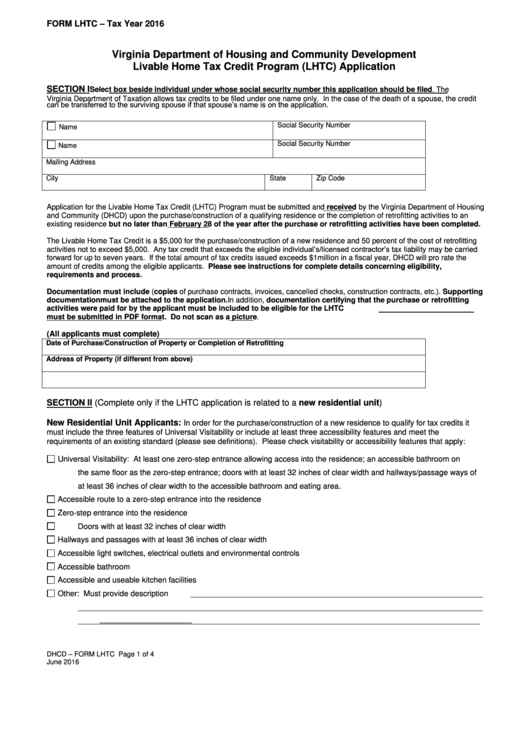

FORM LHTC – Tax Year 2016

Virginia Department of Housing and Community Development

Livable Home Tax Credit Program (LHTC) Application

SECTION I

Select box beside individual under whose social security number this application should be filed. The

Virginia Department of Taxation allows tax credits to be filed under one name only. In the case of the death of a spouse, the credit

can be transferred to the surviving spouse if that spouse’s name is on the application.

Social Security Number

Name

Social Security Number

Name

Mailing Address

City

State

Zip Code

Application for the Livable Home Tax Credit (LHTC) Program must be submitted and received by the Virginia Department of Housing

and Community (DHCD) upon the purchase/construction of a qualifying residence or the completion of retrofitting activities to an

existing residence but no later than February 28 of the year after the purchase or retrofitting activities have been completed.

The Livable Home Tax Credit is a $5,000 for the purchase/construction of a new residence and 50 percent of the cost of retrofitting

activities not to exceed $5,000. Any tax credit that exceeds the eligible individual’s/licensed contractor’s tax liability may be carried

forward for up to seven years. If the total amount of tax credits issued exceeds $1million in a fiscal year, DHCD will pro rate the

amount of credits among the eligible applicants. Please see instructions for complete details concerning eligibility,

requirements and process.

Documentation must include (copies of purchase contracts, invoices, cancelled checks, construction contracts, etc.). Supporting

documentation must be attached to the application. In addition, documentation certifying that the purchase or retrofitting

activities were paid for by the applicant must be included to be eligible for the LHTC program. All scanned documentation

must be submitted in PDF format. Do not scan as a picture.

(All applicants must complete)

Date of Purchase/Construction of Property or Completion of Retrofitting

Address of Property (if different from above)

SECTION II

(Complete only if the LHTC application is related to a new residential unit)

New Residential Unit Applicants:

In order for the purchase/construction of a new residence to qualify for tax credits it

must include the three features of Universal Visitability or include at least three accessibility features and meet the

requirements of an existing standard (please see definitions). Please check visitability or accessibility features that apply:

Universal Visitability: At least one zero-step entrance allowing access into the residence; an accessible bathroom on

the same floor as the zero-step entrance; doors with at least 32 inches of clear width and hallways/passage ways of

at least 36 inches of clear width to the accessible bathroom and eating area.

Accessible route to a zero-step entrance into the residence

Zero-step entrance into the residence

Doors with at least 32 inches of clear width

Hallways and passages with at least 36 inches of clear width

Accessible light switches, electrical outlets and environmental controls

Accessible bathroom

Accessible and useable kitchen facilities

Other: Must provide description

_____________________

DHCD – FORM LHTC

Page 1 of 4

June 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2