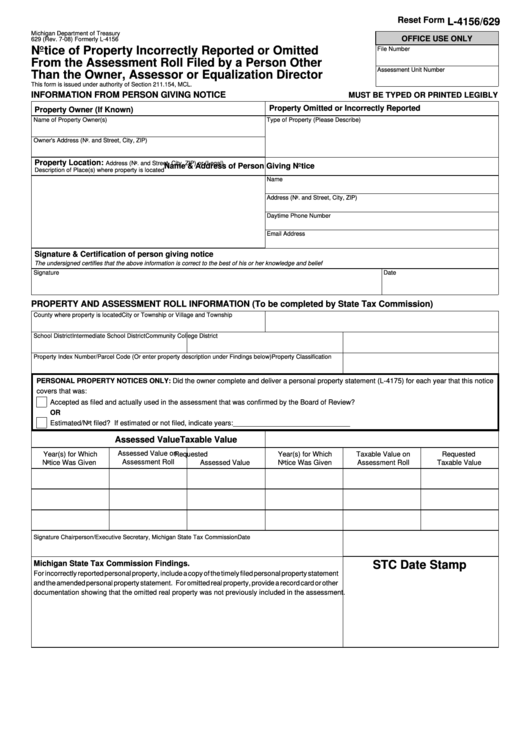

Reset Form

L-4156/629

Michigan Department of Treasury

OFFICE USE ONLY

629 (Rev. 7-08) Formerly L-4156

Notice of Property Incorrectly Reported or Omitted

File Number

From the Assessment Roll Filed by a Person Other

Assessment Unit Number

Than the Owner, Assessor or Equalization Director

This form is issued under authority of Section 211.154, MCL.

INFORMATION FROM PERSON GIVING NOTICE

MUST BE TYPED OR PRINTED LEGIBLY

Property Omitted or Incorrectly Reported

Property Owner (If Known)

Name of Property Owner(s)

Type of Property (Please Describe)

Owner's Address (No. and Street, City, ZIP)

Property Location:

Address (No. and Street, City, ZIP) or (Legal)

Name & Address of Person Giving Notice

Description of Place(s) where property is located

Name

Address (No. and Street, City, ZIP)

Daytime Phone Number

Email Address

Signature & Certification of person giving notice

The undersigned certifies that the above information is correct to the best of his or her knowledge and belief

Signature

Date

PROPERTY AND ASSESSMENT ROLL INFORMATION (To be completed by State Tax Commission)

County where property is located

City or Township or Village and Township

School District

Intermediate School District

Community College District

Property Index Number/Parcel Code (Or enter property description under Findings below)

Property Classification

PERSONAL PROPERTY NOTICES ONLY: Did the owner complete and deliver a personal property statement (L-4175) for each year that this notice

covers that was:

Accepted as filed and actually used in the assessment that was confirmed by the Board of Review?

OR

Estimated/Not filed? If estimated or not filed, indicate years:______________________________

Assessed Value

Taxable Value

Assessed Value on

Year(s) for Which

Requested

Year(s) for Which

Taxable Value on

Requested

Assessment Roll

Notice Was Given

Assessed Value

Notice Was Given

Assessment Roll

Taxable Value

Signature Chairperson/Executive Secretary, Michigan State Tax Commission

Date

STC Date Stamp

Michigan State Tax Commission Findings.

For incorrectly reported personal property, include a copy of the timely filed personal property statement

and the amended personal property statement. For omitted real property, provide a record card or other

documentation showing that the omitted real property was not previously included in the assessment.

1

1 2

2