Reset Form

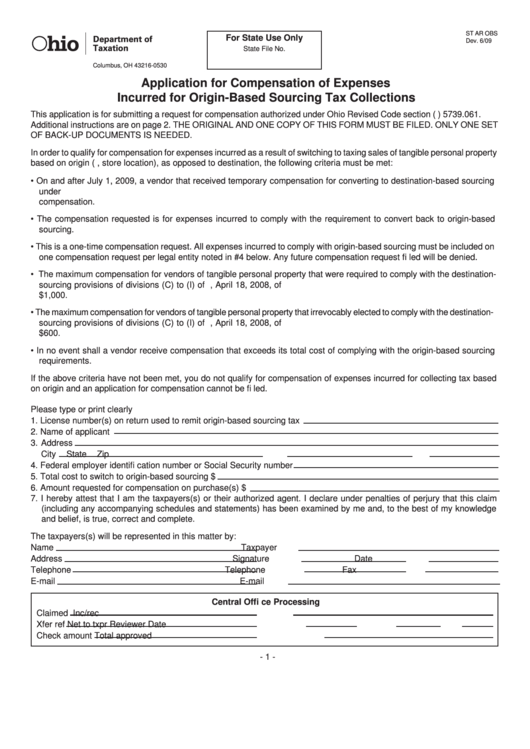

hio

ST AR OBS

Department of

For State Use Only

Dev. 6/09

Taxation

State File No.

P.O. Box 530

Columbus, OH 43216-0530

Application for Compensation of Expenses

Incurred for Origin-Based Sourcing Tax Collections

This application is for submitting a request for compensation authorized under Ohio Revised Code section (R.C.) 5739.061.

Additional instructions are on page 2. THE ORIGINAL AND ONE COPY OF THIS FORM MUST BE FILED. ONLY ONE SET

OF BACK-UP DOCUMENTS IS NEEDED.

In order to qualify for compensation for expenses incurred as a result of switching to taxing sales of tangible personal property

based on origin (e.g., store location), as opposed to destination, the following criteria must be met:

• On and after July 1, 2009, a vendor that received temporary compensation for converting to destination-based sourcing

under R.C. 5739.123 as that section existed before its repeal by H.B. 429 of the 127th General Assembly may apply for

compensation.

• The compensation requested is for expenses incurred to comply with the requirement to convert back to origin-based

sourcing.

• This is a one-time compensation request. All expenses incurred to comply with origin-based sourcing must be included on

one compensation request per legal entity noted in #4 below. Any future compensation request fi led will be denied.

• The maximum compensation for vendors of tangible personal property that were required to comply with the destination-

sourcing provisions of divisions (C) to (I) of R.C. 5739.033 before the effective date, April 18, 2008, of R.C. 5739.061 is

$1,000.

• The maximum compensation for vendors of tangible personal property that irrevocably elected to comply with the destination-

sourcing provisions of divisions (C) to (I) of R.C. 5739.033 before the effective date, April 18, 2008, of R.C. 5739.061 is

$600.

• In no event shall a vendor receive compensation that exceeds its total cost of complying with the origin-based sourcing

requirements.

If the above criteria have not been met, you do not qualify for compensation of expenses incurred for collecting tax based

on origin and an application for compensation cannot be fi led.

Please type or print clearly

1. License number(s) on return used to remit origin-based sourcing tax

2. Name of applicant

3. Address

City

State

Zip

4. Federal employer identifi cation number or Social Security number

5. Total cost to switch to origin-based sourcing $

6. Amount requested for compensation on purchase(s) $

7. I hereby attest that I am the taxpayers(s) or their authorized agent. I declare under penalties of perjury that this claim

(including any accompanying schedules and statements) has been examined by me and, to the best of my knowledge

and belief, is true, correct and complete.

The taxpayers(s) will be represented in this matter by:

Name

Taxpayer

Address

Signature

Date

Telephone

Telephone

Fax

E-mail

E-mail

Central Offi ce Processing

Claimed

Inc/rec

Xfer ref

Net to txpr

Reviewer

Date

Check amount

Total approved

- 1 -

1

1 2

2