Form Ct-8886 - Listed Transaction Disclosure Statement

ADVERTISEMENT

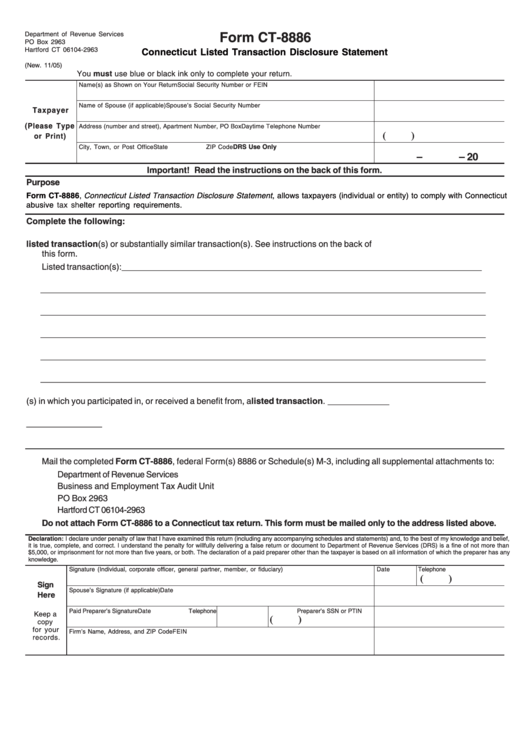

Form CT-8886

Department of Revenue Services

PO Box 2963

Hartford CT 06104-2963

Connecticut Listed Transaction Disclosure Statement

(New. 11/05)

You must use blue or black ink only to complete your return.

Name(s) as Shown on Your Return

Social Security Number or FEIN

Name of Spouse (if applicable)

Spouse’s Social Security Number

Taxpayer

(Please Type

Address (number and street), Apartment Number, PO Box

Daytime Telephone Number

(

)

or Print)

DRS Use Only

City, Town, or Post Office

State

ZIP Code

–

– 20

Important! Read the instructions on the back of this form.

Purpose

Form CT-8886, Connecticut Listed Transaction Disclosure Statement, allows taxpayers (individual or entity) to comply with Connecticut

abusive

tax

shelter reporting requirements.

Complete the following:

1. Provide a description of the listed transaction(s) or substantially similar transaction(s). See instructions on the back of

this form.

Listed transaction(s): ____________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

2. Enter the taxable year(s) in which you participated in, or received a benefit from, a listed transaction. _____________

3. Enter the number of federal forms attached to this form. See instructions on the back of this form. ________________

Mail the completed Form CT-8886, federal Form(s) 8886 or Schedule(s) M-3, including all supplemental attachments to:

Department of Revenue Services

Business and Employment Tax Audit Unit

PO Box 2963

Hartford CT 06104-2963

Do not attach Form CT-8886 to a Connecticut tax return. This form must be mailed only to the address listed above.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief,

it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to Department of Revenue Services (DRS) is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any

knowledge.

Signature (Individual, corporate officer, general partner, member, or fiduciary)

Date

Telephone

(

)

Sign

Spouse’s Signature (if applicable)

Date

Here

Paid Preparer’s Signature

Date

Telephone

Preparer’s SSN or PTIN

Keep a

(

)

copy

for your

Firm’s Name, Address, and ZIP Code

FEIN

records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1