Form Wc-1 - Workers' Compensation Fee Form - Taxation And Revenue Department

ADVERTISEMENT

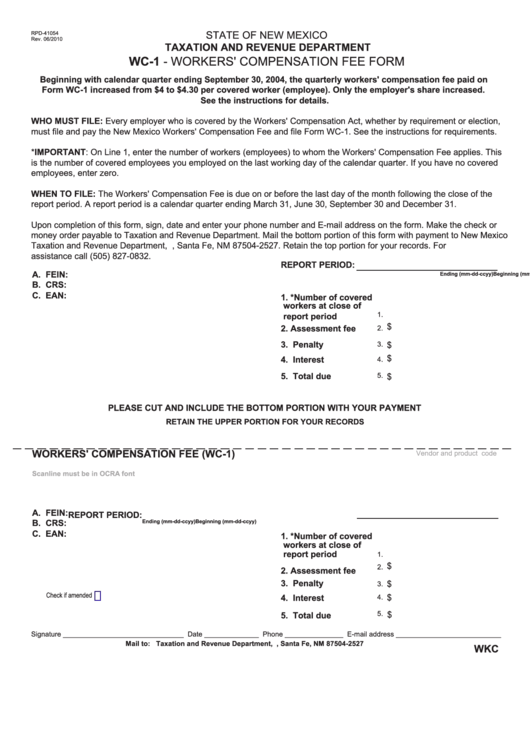

STATE OF NEW MEXICO

RPD-41054

Rev. 06/2010

TAXATION AND REVENUE DEPARTMENT

WC-1 - WORKERS' COMPENSATION FEE FORM

Beginning with calendar quarter ending September 30, 2004, the quarterly workers' compensation fee paid on

Form WC-1 increased from $4 to $4.30 per covered worker (employee). Only the employer's share increased.

See the instructions for details.

WHO MUST FILE: Every employer who is covered by the Workers' Compensation Act, whether by requirement or election,

must file and pay the New Mexico Workers' Compensation Fee and file Form WC-1. See the instructions for requirements.

*IMPORTANT: On Line 1, enter the number of workers (employees) to whom the Workers' Compensation Fee applies. This

is the number of covered employees you employed on the last working day of the calendar quarter. If you have no covered

employees, enter zero.

WHEN TO FILE: The Workers' Compensation Fee is due on or before the last day of the month following the close of the

report period. A report period is a calendar quarter ending March 31, June 30, September 30 and December 31.

Upon completion of this form, sign, date and enter your phone number and E-mail address on the form. Make the check or

money order payable to Taxation and Revenue Department. Mail the bottom portion of this form with payment to New Mexico

Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527. Retain the top portion for your records. For

assistance call (505) 827-0832.

REPORT PERIOD:

A. FEIN:

Beginning (mm-dd-ccyy)

Ending (mm-dd-ccyy)

B. CRS:

C. EAN:

1. *Number of covered

workers at close of

1.

report period

$

2. Assessment fee

2.

3. Penalty

$

3.

$

4. Interest

4.

5. Total due

5.

$

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

WORKERS' COMPENSATION FEE (WC-1)

Vendor and product code

Scanline must be in OCRA font

A. FEIN:

REPORT PERIOD:

B. CRS:

Beginning (mm-dd-ccyy)

Ending (mm-dd-ccyy)

C. EAN:

1. *Number of covered

workers at close of

report period

1.

$

2.

2. Assessment fee

3. Penalty

$

3.

Check if amended

$

4. Interest

4.

5.

$

5. Total due

Signature _______________________________ Date ______________ Phone _______________ E-mail address ___________________________

Mail to: Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527

WKC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1