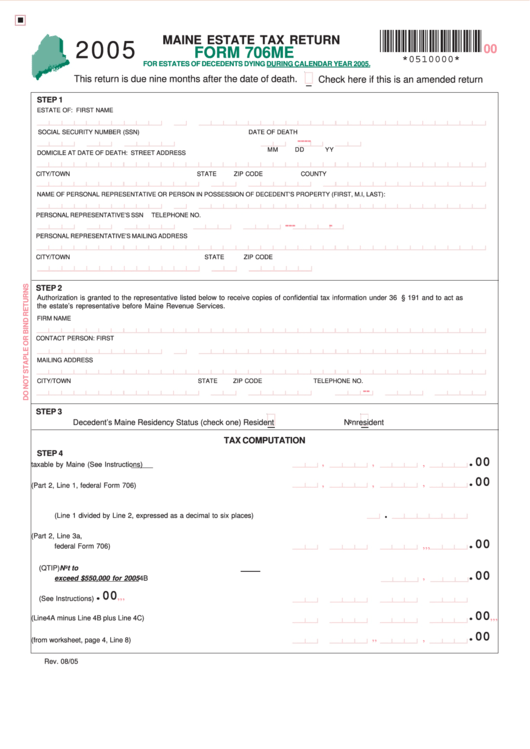

Form 706me - Maine Estate Tax Return

ADVERTISEMENT

2005

MAINE ESTATE TAX RETURN

00

FORM 706ME

*0510000*

FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2005.

This return is due nine months after the date of death.

Check here if this is an amended return

STEP 1

ESTATE OF: FIRST NAME

M.I.

LAST NAME

SOCIAL SECURITY NUMBER (SSN)

DATE OF DEATH

-

-

-

-

MM

DD

YY

DOMICILE AT DATE OF DEATH: STREET ADDRESS

CITY/TOWN

STATE

ZIP CODE

COUNTY

NAME OF PERSONAL REPRESENTATIVE OR PERSON IN POSSESSION OF DECEDENT’S PROPERTY (FIRST, M.I, LAST):

PERSONAL REPRESENTATIVE’S SSN

TELEPHONE NO.

-

-

-

-

PERSONAL REPRESENTATIVE’S MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

STEP 2

Authorization is granted to the representative listed below to receive copies of confidential tax information under 36 M.R.S.A. § 191 and to act as

the estate’s representative before Maine Revenue Services.

FIRM NAME

CONTACT PERSON: FIRST

M.I.

LAST

MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

TELEPHONE NO.

-

-

STEP 3

Decedent’s Maine Residency Status (check one)

Resident

Nonresident

TAX COMPUTATION

STEP 4

.00

,

,

,

1.

Gross value of property taxable by Maine (See Instructions) .................. 1

.00

,

,

,

2.

Value of total federal gross estate (Part 2, Line 1, federal Form 706) ...... 2

3.

Percent of property taxable by Maine

.

(Line 1 divided by Line 2, expressed as a decimal to six places) ............ 3

4A. Federal taxable estate for federal tax purposes (Part 2, Line 3a,

.00

,

,

,

federal Form 706) .................................................................................... 4A

4B. Elected Maine Qualified Terminable Interest Property (QTIP) Not to

.00

,

exceed $550,000 for 2005 ...................................................................... 4B

.00

,

,

,

4C. Maine Elective Property (See Instructions) .............................................. 4C

.00

,

,

,

4D. Maine Taxable Estate (Line 4A minus Line 4B plus Line 4C) ................... 4D

.00

,

,

,

5.

Maine Gross Estate Tax (from worksheet, page 4, Line 8) ....................... 5

Rev. 08/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2