Form Ir - Income Tax Return 2001 Page 2

Download a blank fillable Form Ir - Income Tax Return 2001 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Ir - Income Tax Return 2001 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

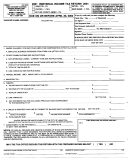

2001 FAIRFIELD TAX FORM IR – SIDE TWO

12.

TAXABLE INCOME NOT REPORTED UPON A W-2 FORM: ATTACH COPY APPROPRIATE FEDERAL INCOME REPORTING FORM(S)................$ ________________

(NOTE: Income reported on 1099-INT, 1099-R, 1099-D, 1099-G & W2P are not taxable)

13.

NET PROFIT(S) (LOSS) FOR PROFESSION AND/OR BUSINESS OPERATION(S): ATTACH FEDERAL SCHEDULE C ....$ ________________

14.

NET PROFIT(S) (LOSS) FROM RENTAL PROPERTY AND/OR PARTNERSHIP(S): ATTACH FEDERAL SCHEDULE E ........$ ________________

(“S” CORPORATIONS ARE EXCLUDED FROM INDIVIDUAL’S INCOME)

0.00

15.

TOTAL NET PROFITS (LOSSES) FROM BUSINESS ACTIVITIES: LINE 13 PLUS LINE 14, IF RESULT IS A LOSS, ..........$ ________________

AMOUNT ONLY MAY BE CARRIED FORWARD TO LINE 16 ON TAX RETURNS FOR 2002, 2003 AND 2004 OR

UNTIL EXHAUSTED.

16.

BUSINESS LOSS TOTAL FROM PREVIOUS TAX RETURNS: LIMITED TO THREE (3) YEARS: 1998, 1999 AND 2000 ......$ ________________

0.00

17.

SUBTRACT LINE 16 FROM LINE 15: ........................................................................................................................................$ ________________

0.00

18.

IF THE CALCULATION ON LINE 17 (LINE 15 MINUS LINE 16) RESULTS IN A NET GAIN LIST THE AMOUNT ON THIS LINE ................................$ ________________

IF THE CALCULATION RESULTS IN A NET LOSS, A PORTION AS CALCULATED BY THE 3 YEAR LIMITATION MAY BE

USED TO OFFSET FUTURE PROFITS. HOWEVER, A LOSS MAY NOT BE USED AS A DEDUCTION FROM WAGE/SALARY

TYPE EARNINGS OR MISC. INCOME.

19.

DEDUCTIONS AND NON-TAXABLE INCOME: SEE INSTRUCTIONS FOR DETAILS

A. ________________________________________________________________________________________________ $ ________________

B. ________________________________________________________________________________________________ $ ________________

0.00

C. TOTAL DEDUCTIONS AND/OR NON-TAXABLE INCOME: LINE 19A PLUS LINE 19B ............................................................................................$ ________________

0.00

20.

TOTAL OTHER TAXABLE INCOME OR DEDUCTIONS: LINE 12 PLUS LINE 18 MINUS LINE 19C (ALSO ENTER THIS TOTAL ON LINE 2) ..............$ ________________

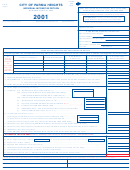

PAYING TAX DUE BY CREDIT CARD

Circle One:

1

R

Account Number (16 Digits) __________

__________

__________

__________

2

Expiration Date: ________________________

3

Amount to be Paid: $ ________________________

4

Your Signature for Authorization: ______________________________________________________

5

To determine if this transaction will be treated as a cash advance when paid to CITY OF FAIRFIELD TAX, please check with your credit

card issuing company.

LATE FILING AND PAYMENT CHARGES

Interest: All taxes and declarations remaining unpaid after prescribed due dates shall bear

interest at the rate of 1% per month or fraction thereof.

Penalty: Filing and/or paying taxes after April 30, 2002 shall bear penalty at the greater rate

of $50.00 or 2% per month (5% after one year) or fraction thereof.

TAX RETURN FILING AND PAYMENT CALENDAR

ON OR BEFORE

ON OR BEFORE

4/30/02

ON OR BEFORE

ON OR BEFORE

ON OR BEFORE

4/30/03

FILE 2001 TAX RETURN,

7/31/02

10/31/02

1/31/03

FILE 2002 TAX RETURN,

PAY ANY TAX DUE PLUS

PAY 2nd QUARTER

PAY 3rd QUARTER

PAY 4th QUARTER

PAY ANY TAX DUE PLUS

1/4 2002 TAX ESTIMATE

2002 TAX ESTIMATE

2002 TAX ESTIMATE

2002 TAX ESTIMATE

1/4 2003 TAX ESTIMATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2