Form Ir - Income Tax Return 2001

Download a blank fillable Form Ir - Income Tax Return 2001 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Ir - Income Tax Return 2001 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

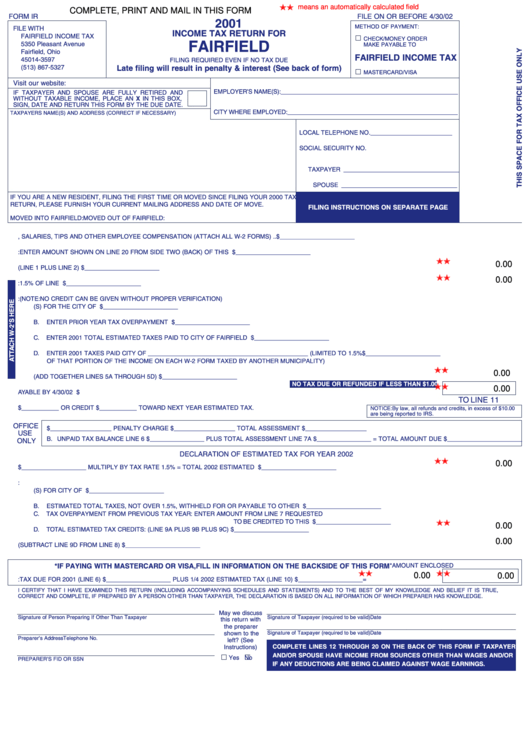

means an automatically calculated field

COMPLETE, PRINT AND MAIL IN THIS FORM

FORM IR

FILE ON OR BEFORE 4/30/02

2001

METHOD OF PAYMENT:

FILE WITH

INCOME TAX RETURN FOR

FAIRFIELD INCOME TAX

CHECK/MONEY ORDER

FAIRFIELD

5350 Pleasant Avenue

MAKE PAYABLE TO

Fairfield, Ohio

FAIRFIELD INCOME TAX

45014-3597

FILING REQUIRED EVEN IF NO TAX DUE

(513) 867-5327

Late filing will result in penalty & interest (See back of form)

MASTERCARD/VISA

Visit our website:

EMPLOYER’S NAME(S):____________________________________________________

IF TAXPAYER AND SPOUSE ARE FULLY RETIRED AND

WITHOUT TAXABLE INCOME, PLACE AN X IN THIS BOX,

SIGN, DATE AND RETURN THIS FORM BY THE DUE DATE.

CITY WHERE EMPLOYED:__________________________________________________

TAXPAYERS NAME(S) AND ADDRESS (CORRECT IF NECESSARY)

LOCAL TELEPHONE NO. ________________________

SOCIAL SECURITY NO.

TAXPAYER __________________________________

SPOUSE __________________________________

IF YOU ARE A NEW RESIDENT, FILING THE FIRST TIME OR MOVED SINCE FILING YOUR 2000 TAX

RETURN, PLEASE FURNISH YOUR CURRENT MAILING ADDRESS AND DATE OF MOVE.

FILING INSTRUCTIONS ON SEPARATE PAGE

MOVED INTO FAIRFIELD:

MOVED OUT OF FAIRFIELD:

1.

ENTER TOTAL OF ALL GROSS WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (ATTACH ALL W-2 FORMS)..........................$______________________

2.

TOTAL OTHER TAXABLE INCOME OR DEDUCTIONS: ENTER AMOUNT SHOWN ON LINE 20 FROM SIDE TWO (BACK) OF THIS FORM ..............$______________________

0.00

3.

TOTAL TAXABLE INCOME (LINE 1 PLUS LINE 2) ..............................................................................................................................................................$______________________

0.00

4.

FAIRFIELD TAX: 1.5% OF LINE 3..........................................................................................................................................................................................$______________________

5.

TAX CREDITS: (NOTE: NO CREDIT CAN BE GIVEN WITHOUT PROPER VERIFICATION)

A.

ENTER TOTAL TAXES WITHHELD BY EMPLOYER(S) FOR THE CITY OF FAIRFIELD..................................................$______________________

B.

ENTER PRIOR YEAR TAX OVERPAYMENT AMOUNT......................................................................................................$______________________

C.

ENTER 2001 TOTAL ESTIMATED TAXES PAID TO CITY OF FAIRFIELD ........................................................................$______________________

D.

ENTER 2001 TAXES PAID CITY OF _______________________________________________ (LIMITED TO 1.5%

$______________________

OF THAT PORTION OF THE INCOME ON EACH W-2 FORM TAXED BY ANOTHER MUNICIPALITY)

0.00

E.

TOTAL TAX CREDITS (ADD TOGETHER LINES 5A THROUGH 5D) ..........................................................................................................................$______________________

NO TAX DUE OR REFUNDED IF LESS THAN $1.00

0.00

6.

IF LINE 4 IS GREATER THAN LINE 5E ENTER DIFFERENCE ON THIS LINE ............................................2001 TAX DUE AND PAYABLE BY 4/30/02 $

TO LINE 11

7.

TAX OVERPAID TO BE REFUNDED $___________ OR CREDIT $___________ TOWARD NEXT YEAR ESTIMATED TAX.

NOTICE: By law, all refunds and credits, in excess of $10.00

are being reported to IRS.

OFFICE

A. INTEREST CHARGE $__________________ PENALTY CHARGE $__________________ TOTAL ASSESSMENT $__________________

USE

B. UNPAID TAX BALANCE LINE 6 $________________ PLUS TOTAL ASSESSMENT LINE 7A $________________ = TOTAL AMOUNT DUE $ ______________________

ONLY

DECLARATION OF ESTIMATED TAX FOR YEAR 2002

0.00

8.

ENTER TOTAL ESTIMATED 2002 INCOME $___________________ MULTIPLY BY TAX RATE 1.5% = TOTAL 2002 ESTIMATED TAX ........................$______________________

9.

ESTIMATED TAX CREDITS:

A.

ESTIMATED TOTAL TAXES TO BE WITHHELD BY EMPLOYER(S) FOR CITY OF FAIRFIELD ......................................$______________________

B.

ESTIMATED TOTAL TAXES, NOT OVER 1.5%, WITHHELD FOR OR PAYABLE TO OTHER CITIES ..............................$______________________

C.

TAX OVERPAYMENT FROM PREVIOUS TAX YEAR: ENTER AMOUNT FROM LINE 7 REQUESTED

TO BE CREDITED TO THIS ESTIMATE ..............$______________________

0.00

D.

TOTAL ESTIMATED TAX CREDITS: (LINE 9A PLUS 9B PLUS 9C) ............................................................................................................................$______________________

0.00

10.

TOTAL ESTIMATED TAX DUE AND PAYABLE TO FAIRFIELD DURING 2002 (SUBTRACT LINE 9D FROM LINE 8)........................................................$______________________

*AMOUNT ENCLOSED

*IF PAYING WITH MASTERCARD OR VISA, FILL IN INFORMATION ON THE BACKSIDE OF THIS FORM

0.00

0.00

11.

TOTAL AMOUNT DUE: TAX DUE FOR 2001 (LINE 6) $___________________ PLUS 1/4 2002 ESTIMATED TAX (LINE 10) $___________________ =

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE,

CORRECT AND COMPLETE, IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS KNOWLEDGE.

May we discuss

Signature of Person Preparing If Other Than Taxpayer

Signature of Taxpayer (required to be valid)

Date

this return with

the preparer

shown to the

Signature of Taxpayer (required to be valid)

Date

Preparer’s Address

Telephone No.

left? (See

COMPLETE LINES 12 THROUGH 20 ON THE BACK OF THIS FORM IF TAXPAYER

Instructions)

AND/OR SPOUSE HAVE INCOME FROM SOURCES OTHER THAN WAGES AND/OR

Yes

No

PREPARER’S FID OR SSN

IF ANY DEDUCTIONS ARE BEING CLAIMED AGAINST WAGE EARNINGS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2