Quarterly Sales Tax Return Form - Town Of Carbondale Page 2

ADVERTISEMENT

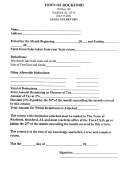

Town of Carbondale

SALES TAX RETURN INSTRUCTIONS

If you deliver or ship product out of the Town of Carbondale and you are unsure of the “in/out” status of the address, please email, call,

L

3C

INE

or fax the Tax Administration Department for verification. An address locator is available on our website and by request.

Sales to exempt organizations must be supported by a “State of Colorado” exemption certificate. Place the exempt number of the

L

3G

INE

organization on your return. The number must begin with “98” (i.e., 98-xxxxx).

Only food purchased with Food Stamps, or Women, Infants, & Children (WIC) vouchers may be deducted. The Town of Carbondale’s

L

3J

tax rate on “Food for Home Consumption” is 3.5%. Do not deduct food sold unless stamps or vouchers are collected from the customer.

INE

Food and drink sold “ready to eat”, or food sold as “immediate consumption”, are taxed at the full applicable rate.

If sales taxes collected, during the reporting period, exceed the amount calculated on Line 4, you must report and remit the excess on

L

6

INE

this line.

This amount reimburses the vendor for collecting our sales tax. It is not an additional cost to the vendor. Do not add this calculation to

L

8

INE

the tax. The amount you keep is limited to $200 per return. NOT APPLICABLE ON LATE RETURNS.

Penalty calculation: Late returns will be assessed a penalty equal to the sum of ten percent (10%).

Interest calculation: Late returns are assessed interest equal to 1.5% per month from the due date of the payment. For example,

interest on a late return for the period of May 1

through May 31

is calculated as followed:

st

st

Date Filed

Number of Months Late

Interest Due

L

11

INE

June 1

- June 20

0

None

st

th

June 21

- July 20

1

Tax Due x 1.5% x 1

st

th

July 21

– August 20

2

Tax Due x 1.5% x 2

st

th

August 21

– September 20

3

Tax Due x 1.5% x 3

st

th

If you received a credit notice, please deduct the credit amount here.

L

12

INE

If you received a notice of assessment for underpaid tax, please add the total amount of the assessment due here.

Returns are due on the 20

day of the month following the reporting period.

th

For example on a monthly return: The due date for the period of January 1

through January 31

is February 20

.

st

st

th

For example on a quarterly return: The due date for the period of January 1

through March 31

is April 20

.

st

th

th

For example on an annual return: The due date for the period of January 1

through December 31

is January 20

.

st

st

th

L

13

Returns are considered late if the payment or return is not received, or if the envelope is not postmarked by the USPS, on or

INE

before the due date.

YOU MUST FILE THIS RETURN EVEN IF LINE 13 IS ZERO

If your business has been sold to a new owner, sales tax may be due on the selling price of the tangible personal property assets,

S

except for inventory to be resold. Report the taxable sales amount and tax due on a separate tax return noting that the return is for the

ALE OF A

B

sale of the business. See Colorado Revised Statutes -State Code Section 39-26-102(10) for a list of types of business sales that are not

USINESS

subject to sales tax.

Town of Carbondale

Email: tax@carbondaleco.net

Tax Administration Department

Phone: (970) 963-2733

511 Colorado Ave.

Fax: (970) 963-9140

Carbondale, CO 81623

Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2