2001 Estimated Income Tax Instructions And Worksheet

ADVERTISEMENT

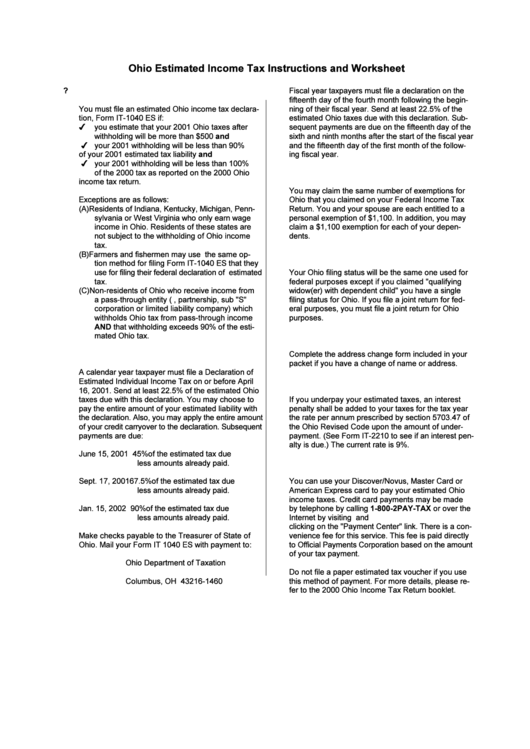

Ohio Estimated Income Tax Instructions and Worksheet

1.

Who Must File Income Tax Declarations?

Fiscal year taxpayers must file a declaration on the

fifteenth day of the fourth month following the begin-

You must file an estimated Ohio income tax declara-

ning of their fiscal year. Send at least 22.5% of the

tion, Form IT-1040 ES if:

estimated Ohio taxes due with this declaration. Sub-

4

you estimate that your 2001 Ohio taxes after

sequent payments are due on the fifteenth day of the

withholding will be more than $500 and

sixth and ninth months after the start of the fiscal year

4 your 2001 withholding will be less than 90%

and the fifteenth day of the first month of the follow-

of your 2001 estimated tax liability and

ing fiscal year.

4 your 2001 withholding will be less than 100%

of the 2000 tax as reported on the 2000 Ohio

3.

Personal and Dependency Exemptions

income tax return.

You may claim the same number of exemptions for

Exceptions are as follows:

Ohio that you claimed on your Federal Income Tax

(A) Residents of Indiana, Kentucky, Michigan, Penn-

Return. You and your spouse are each entitled to a

sylvania or West Virginia who only earn wage

personal exemption of $1,100. In addition, you may

income in Ohio. Residents of these states are

claim a $1,100 exemption for each of your depen-

not subject to the withholding of Ohio income

dents.

tax.

(B) Farmers and fishermen may use the same op-

4.

Joint and Separate Returns

tion method for filing Form IT-1040 ES that they

use for filing their federal declaration of estimated

Your Ohio filing status will be the same one used for

tax.

federal purposes except if you claimed "qualifying

(C) Non-residents of Ohio who receive income from

widow(er) with dependent child" you have a single

a pass-through entity (i.e., partnership, sub "S"

filing status for Ohio. If you file a joint return for fed-

corporation or limited liability company) which

eral purposes, you must file a joint return for Ohio

withholds Ohio tax from pass-through income

purposes.

AND that withholding exceeds 90% of the esti-

5.

Address Change

mated Ohio tax.

2.

Time and Place for Filing and Payment

Complete the address change form included in your

packet if you have a change of name or address.

A calendar year taxpayer must file a Declaration of

Estimated Individual Income Tax on or before April

6.

Interest Penalty

16, 2001. Send at least 22.5% of the estimated Ohio

taxes due with this declaration. You may choose to

If you underpay your estimated taxes, an interest

pay the entire amount of your estimated liability with

penalty shall be added to your taxes for the tax year

the declaration. Also, you may apply the entire amount

the rate per annum prescribed by section 5703.47 of

of your credit carryover to the declaration. Subsequent

the Ohio Revised Code upon the amount of under-

payments are due:

payment. (See Form IT-2210 to see if an interest pen-

alty is due.) The current rate is 9%.

June 15, 2001

45%

of the estimated tax due

less amounts already paid.

7.

Credit Card Payments

Sept. 17, 2001 67.5% of the estimated tax due

You can use your Discover/Novus, Master Card or

less amounts already paid.

American Express card to pay your estimated Ohio

income taxes. Credit card payments may be made

by telephone by calling 1-800-2PAY-TAX or over the

Jan. 15, 2002

90%

of the estimated tax due

less amounts already paid.

Internet by visiting and

clicking on the "Payment Center" link. There is a con-

Make checks payable to the Treasurer of State of

venience fee for this service. This fee is paid directly

Ohio. Mail your Form IT 1040 ES with payment to:

to Official Payments Corporation based on the amount

of your tax payment.

Ohio Department of Taxation

P.O. Box 1460

Do not file a paper estimated tax voucher if you use

Columbus, OH 43216-1460

this method of payment. For more details, please re-

fer to the 2000 Ohio Income Tax Return booklet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2