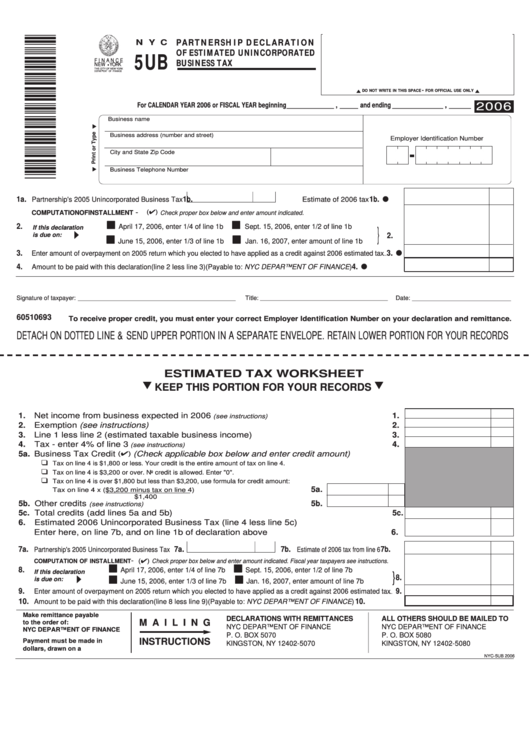

N Y C

PARTNERSHIP DECLARATION

OF ESTIMATED UNINCORPORATED

5UB

F I N A N C E

BUSINESS TAX

NEW YORK

THE CITY OF NEW YORK

DEPAR TMENT OF FINANCE

n y c . g o v / f i n a n c e

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

For CALENDAR YEAR 2006 or FISCAL YEAR beginning _____________ , _____ and ending ______________ , ______

2006

Business name

Business address (number and street)

Employer Identification Number

City and State

Zip Code

Business Telephone Number

1a.

1b.

1b.

Partnership's 2005 Unincorporated Business Tax

Estimate of 2006 tax

...........

-

( ) Check proper box below and enter amount indicated.

COMPUTATION OF INSTALLMENT

2.

April 17, 2006, enter 1/4 of line 1b

Sept. 15, 2006, enter 1/2 of line 1b

If this declaration

.............

}

is due on:

2.

June 15, 2006, enter 1/3 of line 1b

Jan. 16, 2007, enter amount of line 1b

.....

3.

3.

Enter amount of overpayment on 2005 return which you elected to have applied as a credit against 2006 estimated tax

...

4.

4.

Amount to be paid with this declaration (line 2 less line 3) (Payable to: NYC DEPARTMENT OF FINANCE)

........................

Signature of taxpayer:

Title: __________________________________________

Date: _____________________________

_________________________________________________________________________________

60510693

To receive proper credit, you must enter your correct Employer Identification Number on your declaration and remittance.

DETACH ON DOTTED LINE & SEND UPPER PORTION IN A SEPARATE ENVELOPE. RETAIN LOWER PORTION FOR YOUR RECORDS

ESTIMATED TAX WORKSHEET

KEEP THIS PORTION FOR YOUR RECORDS

1. Net income from business expected in 2006

1.

(see instructions)

.......................................................................................

2. Exemption (see instructions)

2.

............................................................................................................................................................................

3. Line 1 less line 2 (estimated taxable business income)

3.

..................................................................................................

4.

Tax - enter 4% of line 3

4.

(see instructions)

..................................................................................................................................................

5a. Business Tax Credit

(Check applicable box below and enter credit amount)

(

)

Tax on line 4 is $1,800 or less. Your credit is the entire amount of tax on line 4.

Tax on line 4 is $3,200 or over. No credit is allowed. Enter "0".

Tax on line 4 is over $1,800 but less than $3,200, use formula for credit amount:

5a.

Tax on line 4 x ($3,200 minus tax on line 4)

...................................................................................

$1,400

5b. Other credits

5b.

(see instructions)

........................................................................................................................

5c. Total credits (add lines 5a and 5b)

5c.

........................................................................................................................................................

6.

Estimated 2006 Unincorporated Business Tax (line 4 less line 5c)

6.

Enter here, on line 7b, and on line 1b of declaration above

..................................................................................

7a.

7a.

7b.

7b.

Partnership's 2005 Unincorporated Business Tax

Estimate of 2006 tax from line 6

..........

-

COMPUTATION OF INSTALLMENT

( ) Check proper box below and enter amount indicated. Fiscal year taxpayers see instructions.

8.

April 17, 2006, enter 1/4 of line 7b

Sept. 15, 2006, enter 1/2 of line 7b

If this declaration

.........................

}

8.

is due on:

June 15, 2006, enter 1/3 of line 7b

Jan. 16, 2007, enter amount of line 7b

................

9.

9.

Enter amount of overpayment on 2005 return which you elected to have applied as a credit against 2006 estimated tax

...

10.

10.

Amount to be paid with this declaration (line 8 less line 9) (Payable to: NYC DEPARTMENT OF FINANCE)

..........................

Make remittance payable

DECLARATIONS WITH REMITTANCES

ALL OTHERS SHOULD BE MAILED TO

M A I L I N G

to the order of:

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

P. O. BOX 5070

P. O. BOX 5080

INSTRUCTIONS

Payment must be made in U.S.

KINGSTON, NY 12402-5070

KINGSTON, NY 12402-5080

dollars, drawn on a U.S. bank.

NYC-5UB 2006

1

1