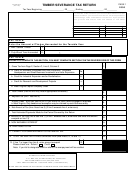

Form Wv/sev-401t - Timber Severance Tax Return - 2007 Page 2

ADVERTISEMENT

SECTION C:

SEVERANCE TAX COMPUTATION SCHEDULE

PAGE 2

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

COLUMN 6

COLUMN 1

CLASS

TYPE OF ACTIVITY

GROSS PROCEEDS

TAXABLE

TAXABLE AMOUNT

RATE PER

GROSS TAX

CODE

OF SALE

PERCENTAGE

(COL 2 X COL 3)

$100

(COL 4 X COL 5)

TIMBER SOLD AT THE POINT IT IS

1

100%

1.22

CUT AND DELIMBED

TIMBER CUT AND TAKEN TO

2

75%

1.22

COLLECTION POINT IN WOODS

3

TIMBER CUT AND DELIVERED TO

1.22

50%

SAWMILL FOR SALE

TIMBER CUT AND PROCESSED

4

25%

1.22

INTO OTHER PRODUCTS

5

TOTAL- Enter here and on Line 1 on Front of Return

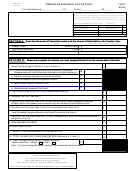

INSTRUCTIONS FOR TIMBER SEVERANCE TAX RETURN WV/SEV-401T

THESE INSTRUCTIONS ARE TO ASSIST YOU IN THE PREPARATION OF THE TAX RETURN AND ARE NOT A SUBSTITUTE FOR THE TAX LAW AND REGULATIONS.

WHO PAYS THE SEVERANCE TAX ON TIMBER?

-

A person who has title to or an "economic interest" in the timber is responsible for paying the severance tax.

-

Even when the timber is cut or processed by someone other than the person who has title to the timber, such as by a contract cutter, the person

who has the economic interest is still responsible for the severance tax.

-

A review of various factors is necessary to determine who has an "economic interest" in the timber. The person who has the right to depletion,

pays royalties to the landowner and has control over the sale of the timber is typically considered to have an "economic interest" in the timber and is

the person who is responsible for the severance tax. A person who is merely providing cutting services for another is not responsible for the

severance tax.

HOW IS THE TAX CALCULATED?

-

Severance tax on timber is imposed on the "gross value" of the timber at the point the tree is cut and delimbed. Effective January 1, 2007, the tax

is calculated by multiplying the "gross value" by the tax rate of 1.22%.

HOW IS THE "GROSS VALUE" OF THE TIMBER DETERMINED?

-

The "gross value" of the timber is the gross proceeds of sale if it is sold at the point it is cut and delimbed.

-

In many instances there is not a sale of the timber at the point of cutting and delimbing. In these instances, the "gross value" can be determined

in one of three ways:

(1) Use of a value that corresponds as closely as possible to the gross proceeds from the sale of similar products of like quality or character.

(2) In the absence of such sales, the "gross value" may be determined using a cost basis. The value of the timber would be the sum of all

costs attributable to the production of timber, including direct and indirect overhead costs and a reasonable mark-up on the timber.

Detailed records must be kept to support the value used for severance tax purposes.

(3) Use of the percentage method. To apply the percentage method of determining the "gross value" subject to tax, the timber producer must

find the activity that is similar to his situation, and apply the appropriate percentages to his gross proceeds of sales.

ACTIVITY

GROSS VALUE CALCULATION

1. A person who cuts timber and takes to collection point in woods

Amount received from sale x 75%

2. A person who cuts timber and delivers to sawmill for sale

Amount received from sale x 50%

3. A person who cuts timber and processes into other products

Amount received from sale x 25%

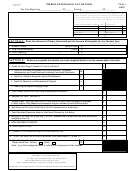

PLEASE ANSWER ALL QUESTIONS;

1. If you purchased this business in the past twelve (12) months, give the previous owner's name and address:________________________________________________

______________________________________________________________________________________________________________________________________________

2. During the period covered by this return, did you: a. Quit business?___________________ Sell or otherwise dispose of your business?__________________________

Exact date: ____________________________________

b. If business was sold, give exact name and address of new owner:________________________________________________________________________________

3. Address where your records are located:________________________________________________________________________________________________________

4. Principal place of business in West Virginia______________________________________________________________________________________________________

5. Nature of business conducted (Describe in detail)_________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________

6. Give name and account number of any additional business(es) operated in West Virginia by the reporting taxpayer:__________________________________________

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements(s) and to the best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer)

(Name of Taxpayer-Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

Signature of Preparer Other than Taxpayer)

(Address)

(Date)

*B21010702A*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2