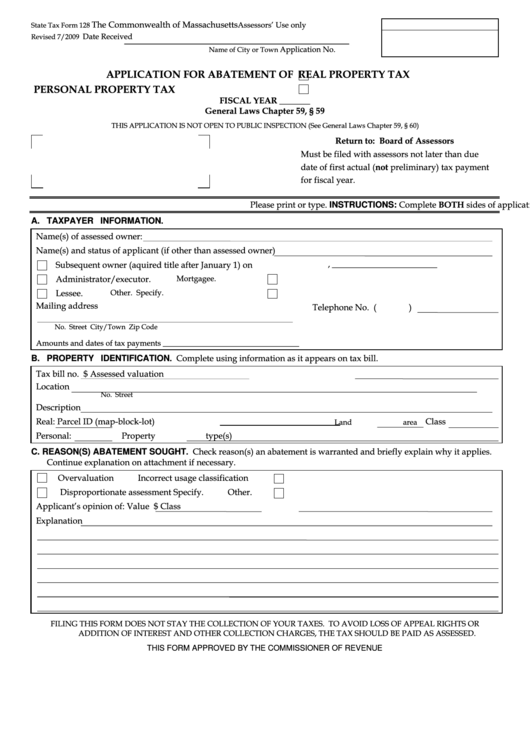

The Commonwealth of Massachusetts

Assessors’ Use only

State Tax Form 128

Date Received

Revised 7/2009

Application No.

Name of City or Town

APPLICATION FOR ABATEMENT OF

REAL PROPERTY TAX

PERSONAL PROPERTY TAX

FISCAL YEAR _______

General Laws Chapter 59, § 59

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION (See General Laws Chapter 59, § 60)

Return to:

Board of Assessors

Must be filed with assessors not later than due

date of first actual (not preliminary) tax payment

for fiscal year.

INSTRUCTIONS: Complete BOTH sides of application.

Please print or type.

A. TAXPAYER INFORMATION.

Name(s) of assessed owner:

Name(s) and status of applicant (if other than assessed owner)

Subsequent owner (aquired title after January 1) on

_________________ __________

,

Administrator/executor.

Mortgagee.

Lessee.

Other. Specify.

Mailing address

Telephone No. (

)

No.

Street

City/Town

Zip Code

Amounts and dates of tax payments ___________________________________

B. PROPERTY IDENTIFICATION. Complete using information as it appears on tax bill.

Tax bill no.

Assessed valuation

$

Location

No.

Street

Description

Parcel ID (map-block-lot)

Real:

Class

Land area

Personal:

Property type(s)

C. REASON(S) ABATEMENT SOUGHT. Check reason(s) an abatement is warranted and briefly explain why it applies.

Continue explanation on attachment if necessary.

Overvaluation

Incorrect usage classification

Disproportionate assessment

Other.

Specify.

Applicant’s opinion of: Value $

Class

Explanation

FILING THIS FORM DOES NOT STAY THE COLLECTION OF YOUR TAXES. TO AVOID LOSS OF APPEAL RIGHTS OR

ADDITION OF INTEREST AND OTHER COLLECTION CHARGES, THE TAX SHOULD BE PAID AS ASSESSED.

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

1

1 2

2