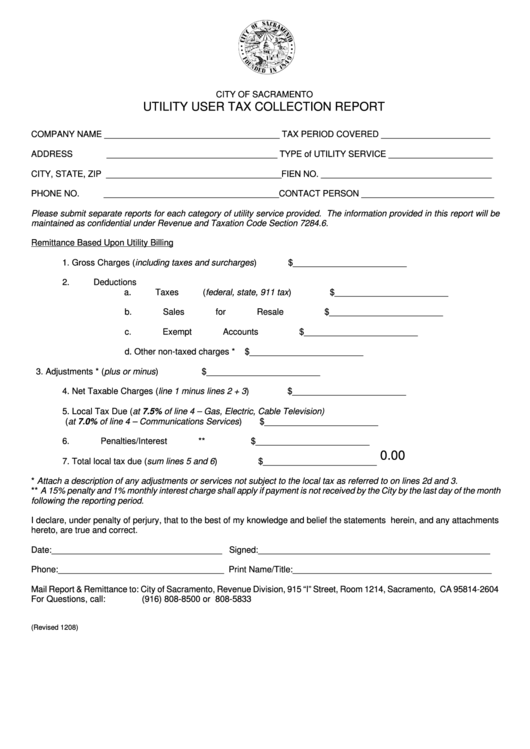

CITY OF SACRAMENTO

UTILITY USER TAX COLLECTION REPORT

COMPANY NAME _____________________________________ TAX PERIOD COVERED _______________________

ADDRESS

____________________________________ TYPE of UTILITY SERVICE ______________________

CITY, STATE, ZIP _____________________________________FIEN NO. ____________________________________

PHONE NO.

_____________________________________CONTACT PERSON ____________________________

Please submit separate reports for each category of utility service provided. The information provided in this report will be

maintained as confidential under Revenue and Taxation Code Section 7284.6.

Remittance Based Upon Utility Billing

1.

Gross Charges (including taxes and surcharges)

$________________________

2.

Deductions

a.

Taxes (federal, state, 911 tax)

$________________________

b.

Sales for Resale

$________________________

c.

Exempt Accounts

$________________________

d.

Other non-taxed charges *

$________________________

3.

Adjustments * (plus or minus)

$________________________

4.

Net Taxable Charges (line 1 minus lines 2 + 3)

$________________________

5.

Local Tax Due (at 7.5% of line 4 – Gas, Electric, Cable Television)

(at 7.0% of line 4 – Communications Services)

$________________________

6.

Penalties/Interest **

$________________________

0.00

7.

Total local tax due (sum lines 5 and 6)

$________________________

* Attach a description of any adjustments or services not subject to the local tax as referred to on lines 2d and 3.

** A 15% penalty and 1% monthly interest charge shall apply if payment is not received by the City by the last day of the month

following the reporting period.

I declare, under penalty of perjury, that to the best of my knowledge and belief the statements herein, and any attachments

hereto, are true and correct.

Date:____________________________________ Signed:_________________________________________________

Phone:___________________________________ Print Name/Title:__________________________________________

Mail Report & Remittance to: City of Sacramento, Revenue Division, 915 “I” Street, Room 1214, Sacramento, CA 95814-2604

For Questions, call:

(916) 808-8500 or 808-5833

(Revised 1208)

1

1 2

2