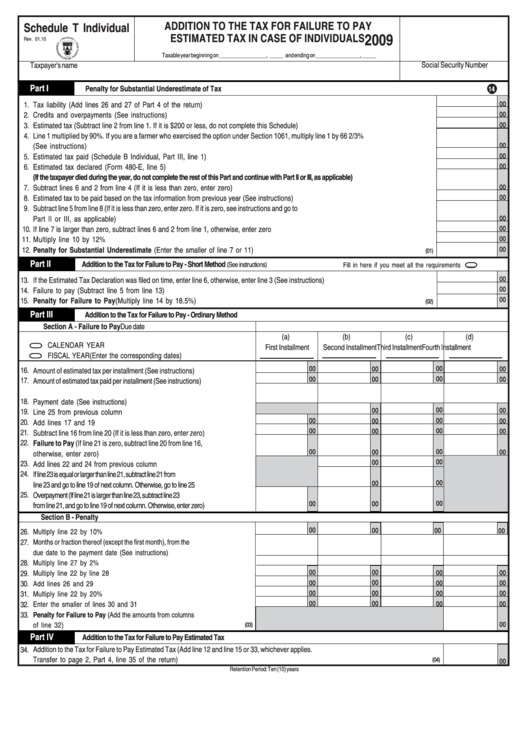

Schedule T Individual - Addition To The Tax For Failure To Pay Estimated Tax In Case Of Individuals - 2009

ADVERTISEMENT

ADDITION TO THE TAX FOR FAILURE TO PAY

Schedule T Individual

2009

ESTIMATED TAX IN CASE OF INDIVIDUALS

Rev. 01.10

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Penalty for Substantial Underestimate of Tax

14

00

1.

Tax liability (Add lines 26 and 27 of Part 4 of the return) .............................................................................................................................

2.

Credits and overpayments (See instructions) ...........................................................................................................................................

00

00

3.

Estimated tax (Subtract line 2 from line 1. If it is $200 or less, do not complete this Schedule) .........................................................................

4.

Line 1 multiplied by 90%. If you are a farmer who exercised the option under Section 1061, multiply line 1 by 66 2/3%

00

(See instructions) .................................................................................................................................................................................

5.

Estimated tax paid (Schedule B Individual, Part III, line 1) ........................................................................................................................

00

6.

Estimated tax declared (Form 480-E, line 5) ............................................................................................................................................

00

(If the taxpayer died during the year, do not complete the rest of this Part and continue with Part II or III, as applicable)

7.

Subtract lines 6 and 2 from line 4 (If it is less than zero, enter zero) .............................................................................................................

00

00

8.

Estimated tax to be paid based on the tax information from previous year (See instructions) ...........................................................................

9.

Subtract line 5 from line 8 (If it is less than zero, enter zero. If it is zero, see instructions and go to

Part II or III, as applicable) ...................................................................................................................................................................

00

00

10.

If line 7 is larger than zero, subtract lines 6 and 2 from line 1, otherwise, enter zero .......................................................................................

11.

Multiply line 10 by 12% ......................................................................................................................................................................

00

00

12.

Penalty for Substantial Underestimate (Enter the smaller of line 7 or 11) ................................................................................................

(01)

Part II

Addition to the Tax for Failure to Pay - Short Method

(See instructions)

Fill in here if you meet all the requirements

00

13.

If the Estimated Tax Declaration was filed on time, enter line 6, otherwise, enter line 3 (See instructions) ..........................................................

00

14.

Failure to pay (Subtract line 5 from line 13) ..............................................................................................................................................

00

15.

Penalty for Failure to Pay (Multiply line 14 by 18.5%) .........................................................................................................................

(02)

Part III

Addition to the Tax for Failure to Pay - Ordinary Method

Section A - Failure to Pay

Due date

(a)

(b)

(c)

(d)

CALENDAR YEAR ......................................................................

First Installment

Second Installment

Third Installment

Fourth Installment

FISCAL YEAR (Enter the corresponding dates) ..................................

00

00

00

00

16.

Amount of estimated tax per installment (See instructions) .............................

00

00

00

00

17.

Amount of estimated tax paid per installment (See instructions) ...........................

18.

Payment date (See instructions) ..................................................................

00

00

00

19.

Line 25 from previous column ...................................................................

00

00

00

00

20.

Add lines 17 and 19 ................................................................................

00

00

00

00

21.

Subtract line 16 from line 20 (If it is less than zero, enter zero) .......................

22.

Failure to Pay (If line 21 is zero, subtract line 20 from line 16,

00

00

00

00

otherwise, enter zero) ..............................................................................

00

00

23.

Add lines 22 and 24 from previous column .................................................

24.

If line 23 is equal or larger than line 21, subtract line 21 from

00

00

line 23 and go to line 19 of next column. Otherwise, go to line 25 ..................................

25.

Overpayment (If line 21 is larger than line 23, subtract line 23

00

00

00

from line 21, and go to line 19 of next column. Otherwise, enter zero) ............................

Section B - Penalty

00

00

00

00

26.

Multiply line 22 by 10% ............................................................................

27.

Months or fraction thereof (except the first month), from the

due date to the payment date (See instructions) ............................................

28.

Multiply line 27 by 2% ..............................................................................

29.

00

00

00

00

Multiply line 22 by line 28 .........................................................................

00

00

00

30.

Add lines 26 and 29 .................................................................................

00

00

00

31.

00

00

Multiply line 22 by 20% ............................................................................

00

00

00

00

32.

Enter the smaller of lines 30 and 31 .............................................................

33.

Penalty for Failure to Pay (Add the amounts from columns

00

of line 32) ..............................................................................................

(03)

Part IV

Addition to the Tax for Failure to Pay Estimated Tax

34.

Addition to the Tax for Failure to Pay Estimated Tax (Add line 12 and line 15 or 33, whichever applies.

Transfer to page 2, Part 4, line 35 of the return) .........................................................................................................................................

(04)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2