Form Mw-1 - Employer'S Return Of Tax Withheld Page 3

ADVERTISEMENT

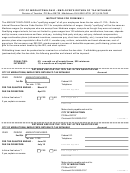

City of Middletown Ohio - WithholdingTax Reconciliation

PO Box 428739 Middletown OH 45042-8739 (513) 425-7862

INSTRUCTIONS FOR FORM MW-3

Copies of W-2's of all employees subject to City of Middletown income tax must accompany this

form. W-2's must be in alphabetical order or sorted by social security number.

Employers with more than 250 employees must submit W-2 information on diskette or CD-Rom using the

Social Security Administrations MMREF-1 filing requirements. All employers are encouraged to use this method

of filing.

If non-employee compensation was paid for work performed in Middletown, copies of 1099-MISC's

must also be submitted.

FILING DEADLINE FEBRUARY 28 (MARCH 31 ELECTRONIC FILING)

If you terminated all your employees before December 31, this reconciliation must be filed within

thirty days after the last payment of wages.

WORKSHEET FOR YOUR RECORDS

Quarter

Ending

Due Date

Check Number

Date

Amount

3/31

4/15

6/30

7/15

9/30

10/15

12/31

1/15

Account

CITY OF MIDDLETOWN OHIO, WITHHOLDING TAX RECONCILIATION

We have no employees working in the City. We withhold as a courtesy for residents

Final Return, explain on reverse

1. Total number of employees

Middletown Income Tax Withheld for Tax Year _____

2. Total payroll for the year

First quarter ending March 31

3. Less payroll not subject to tax

Second quarter ending June 30

(Must include expanation on the reverse)

Third quarter ending September 30

4. Payroll subject to tax

Fourth quarter ending December 31

5. Withholding liability at 1.75% of line 4

6. Total remitted for the year

(Must equal line 5. If not, explain on reverse)

7. Overpayment credited to next year*

OR…….. 8. Additional tax due

*Refund not issued unless requested. Attach explanation.

Enclose payment with return and mail to CITY OF MIDDLETOWN

PO Box 428739 Middletown OH 45042

No taxes or credits of less than $3.00 shall be collected or refunded

EMPLOYER (name and address)

Federal I.D.

Submitted by (Type or Print)

Official Title

Signature

Telephone (_____)

Date

ORIGINAL MUST BE RETURNED WITH W-2'S AND 1099'S BY FEBRUARY 28

FORM MW-3

OR MARCH 31 FOR ELECTRONIC FILERS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3