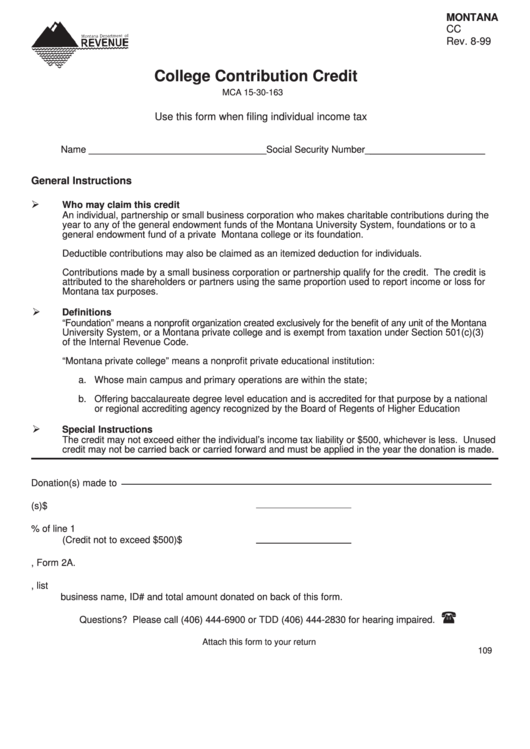

Form Cc - College Contribution Credit

ADVERTISEMENT

MONTANA

CC

Rev. 8-99

College Contribution Credit

MCA 15-30-163

Use this form when filing individual income tax

Name __________________________________Social Security Number_______________________

General Instructions

Who may claim this credit

An individual, partnership or small business corporation who makes charitable contributions during the

year to any of the general endowment funds of the Montana University System, foundations or to a

general endowment fund of a private Montana college or its foundation.

Deductible contributions may also be claimed as an itemized deduction for individuals.

Contributions made by a small business corporation or partnership qualify for the credit. The credit is

attributed to the shareholders or partners using the same proportion used to report income or loss for

Montana tax purposes.

Definitions

“Foundation” means a nonprofit organization created exclusively for the benefit of any unit of the Montana

University System, or a Montana private college and is exempt from taxation under Section 501(c)(3)

of the Internal Revenue Code.

“Montana private college” means a nonprofit private educational institution:

a. Whose main campus and primary operations are within the state;

b. Offering baccalaureate degree level education and is accredited for that purpose by a national

or regional accrediting agency recognized by the Board of Regents of Higher Education

Special Instructions

The credit may not exceed either the individual’s income tax liability or $500, whichever is less. Unused

credit may not be carried back or carried forward and must be applied in the year the donation is made.

Donation(s) made to

1.

Total amount of donation(s)

$

2.

Allowable credit - 10% of line 1

(Credit not to exceed $500)

$

3.

Enter amount from line 2 above on Schedule II, Form 2A.

4.

If amount on line 1 includes a donation made by a small business corporation or partnership, list

business name, ID# and total amount donated on back of this form.

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

Attach this form to your return

109

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1