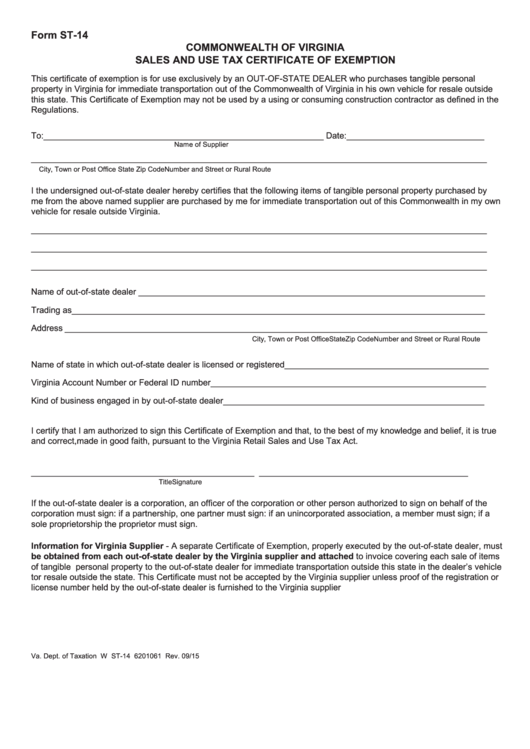

Form ST-14

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

This certificate of exemption is for use exclusively by an OUT-OF-STATE DEALER who purchases tangible personal

property in Virginia for immediate transportation out of the Commonwealth of Virginia in his own vehicle for resale outside

this state. This Certificate of Exemption may not be used by a using or consuming construction contractor as defined in the

Regulations.

To: ___________________________________________________________ Date: _____________________________

Name of Supplier

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

State

Zip Code

I the undersigned out-of-state dealer hereby certifies that the following items of tangible personal property purchased by

me from the above named supplier are purchased by me for immediate transportation out of this Commonwealth in my own

vehicle for resale outside Virginia.

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

Name of out-of-state dealer _________________________________________________________________________

Trading as _______________________________________________________________________________________

Address _________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

State

Zip Code

Name of state in which out-of-state dealer is licensed or registered ___________________________________________

Virginia Account Number or Federal ID number __________________________________________________________

Kind of business engaged in by out-of-state dealer _______________________________________________________

I certify that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true

and correct,made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

_______________________________________________

____________________________________________

Signature

Title

If the out-of-state dealer is a corporation, an officer of the corporation or other person authorized to sign on behalf of the

corporation must sign: if a partnership, one partner must sign: if an unincorporated association, a member must sign; if a

sole proprietorship the proprietor must sign.

Information for Virginia Supplier - A separate Certificate of Exemption, properly executed by the out-of-state dealer, must

be obtained from each out-of-state dealer by the Virginia supplier and attached to invoice covering each sale of items

of tangible personal property to the out-of-state dealer for immediate transportation outside this state in the dealer’s vehicle

tor resale outside the state. This Certificate must not be accepted by the Virginia supplier unless proof of the registration or

license number held by the out-of-state dealer is furnished to the Virginia supplier

Va. Dept. of Taxation W ST-14

6201061

Rev. 09/15

1

1