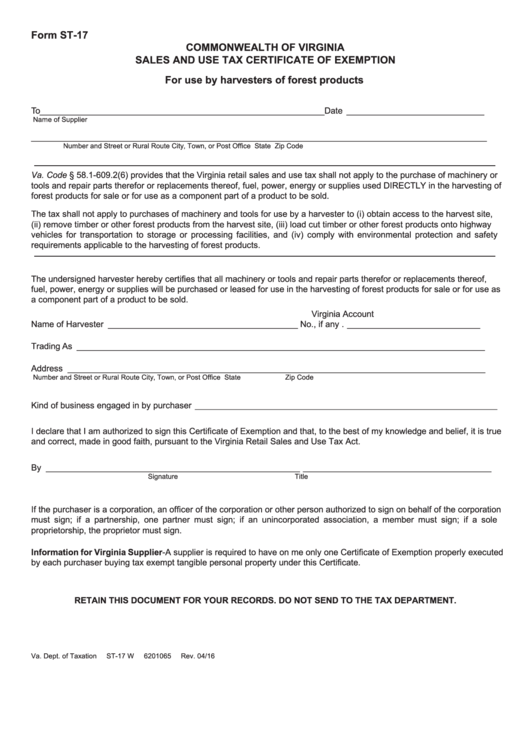

Form ST-17

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by harvesters of forest products

To ____________________________________________________________ Date _____________________________

Name of Supplier

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town, or Post Office

State

Zip Code

Va. Code § 58.1-609.2(6) provides that the Virginia retail sales and use tax shall not apply to the purchase of machinery or

tools and repair parts therefor or replacements thereof, fuel, power, energy or supplies used DIRECTLY in the harvesting of

forest products for sale or for use as a component part of a product to be sold.

The tax shall not apply to purchases of machinery and tools for use by a harvester to (i) obtain access to the harvest site,

(ii) remove timber or other forest products from the harvest site, (iii) load cut timber or other forest products onto highway

vehicles for transportation to storage or processing facilities, and (iv) comply with environmental protection and safety

requirements applicable to the harvesting of forest products.

The undersigned harvester hereby certifies that all machinery or tools and repair parts therefor or replacements thereof,

fuel, power, energy or supplies will be purchased or leased for use in the harvesting of forest products for sale or for use as

a component part of a product to be sold.

Virginia Account

Name of Harvester ________________________________________

No., if any . ____________________________

Trading As ______________________________________________________________________________________

Address ________________________________________________________________________________________

Number and Street or Rural Route

City, Town, or Post Office

State

Zip Code

Kind of business engaged in by purchaser

_____________________________________________________________________

I declare that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true

and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By

__________________________________________________________

___________________________________________

Signature

Title

If the purchaser is a corporation, an officer of the corporation or other person authorized to sign on behalf of the corporation

must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign; if a sole

proprietorship, the proprietor must sign.

Information for Virginia Supplier-A supplier is required to have on me only one Certificate of Exemption properly executed

by each purchaser buying tax exempt tangible personal property under this Certificate.

RETAIN THIS DOCUMENT FOR YOUR RECORDS. DO NOT SEND TO THE TAX DEPARTMENT.

Va. Dept. of Taxation

ST-17 W

6201065

Rev. 04/16

1

1