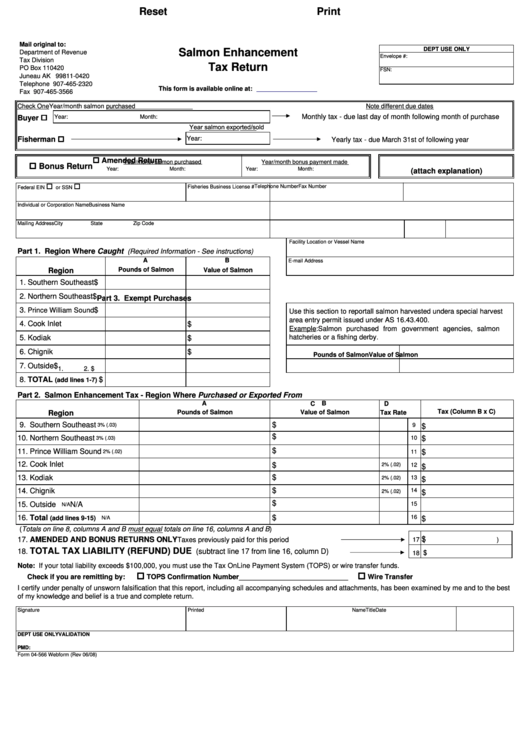

purchased

For Tax Periods After 12/31/2004

Reset

Print

Mail original to:

DEPT USE ONLY

Salmon Enhancement

Department of Revenue

Envelope #:

Tax Division

Tax Return

PO Box 110420

FSN:

Juneau AK 99811-0420

Telephone 907-465-2320

This form is available online at:

Fax 907-465-3566

Year/month salmon purchased

Check One

Note different due dates

Monthly tax - due last day of month following month of purchase

Year:

Month:

Buyer

Year salmon exported/sold

Year salmon exported/sold

Year:

Fisherman

Yearly tax - due March 31st of following year

Amended Return

Year/month salmon purchased

Year/month bonus payment made

Bonus Return

Year:

Month:

Year:

Month:

(attach explanation)

Telephone Number

Fax Number

Fisheries Business License #

Federal EIN

or SSN

Individual or Corporation Name

Business Name

Mailing Address

City

State

Zip Code

Facility Location or Vessel Name

Part 1. Region Where Caught

(Required Information - See instructions)

A

B

E-mail Address

Region

Pounds of Salmon

Value of Salmon

1. Southern Southeast

$

2. Northern Southeast

$

Part 3. Exempt Purchases

3.

Prince William Sound

$

Use this section to report all salmon harvested under a special harvest

area entry permit issued under AS 16.43.400.

4. Cook Inlet

$

Example: Salmon purchased from government agencies, salmon

hatcheries or a fishing derby.

5. Kodiak

$

6. Chignik

$

Pounds of Salmon

Value of Salmon

7. Outside

$

1.

2. $

8. TOTAL

$

(add lines 1-7)

Part 2. Salmon Enhancement Tax - Region Where Purchased or Exported From

A

B

C

D

Tax (Column B x C)

Region

Pounds of Salmon

Value of Salmon

Tax Rate

9. Southern Southeast

$

3% (.03)

9

$

$

10. Northern Southeast

$

10

3% (.03)

$

11. Prince William Sound

$

2% (.02)

11

12. Cook Inlet

$

2% (.02)

12

$

13. Kodiak

$

13

2% (.02)

$

$

14. Chignik

14

2% (.02)

$

$

15. Outside

15

N/A

N/A

$

16. Total

16

$

(add lines 9-15)

N/A

(Totals on line 8, columns A and B must equal totals on line 16, columns A and B )

$

17. AMENDED AND BONUS RETURNS ONLY

Taxes previously paid for this period

17

(

)

TOTAL TAX LIABILITY (REFUND) DUE

18.

(subtract line 17 from line 16, column D)

$

18

Note: If your total liability exceeds $100,000, you must use the Tax OnLine Payment System (TOPS) or wire transfer funds.

Check if you are remitting by:

TOPS Confirmation Number____________________________

Wire Transfer

I certify under penalty of unsworn falsification that this report, including all accompanying schedules and attachments, has been examined by me and to the best

of my knowledge and belief is a true and complete return.

Signature

Printed Name

Title

Date

DEPT USE ONLY

VALIDATION

PMD:

Form 04-566 Webform (Rev 06/08)

1

1