Form X-3 - Correction - Hawaii 2000

ADVERTISEMENT

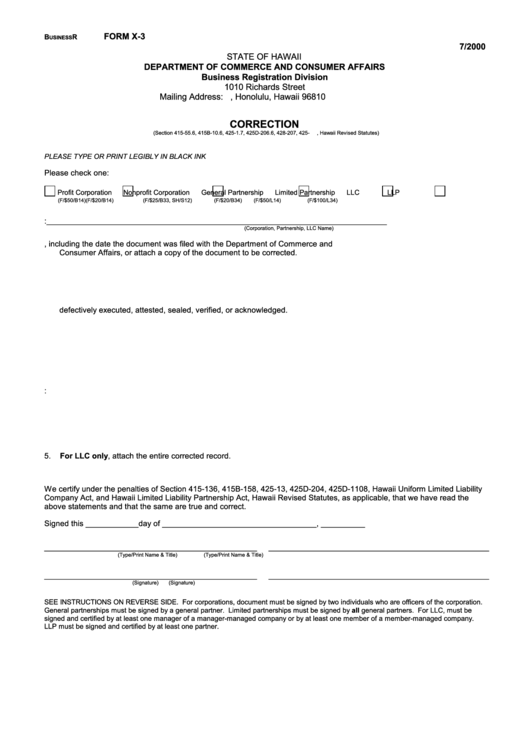

FORM X-3

B

R

WWW.

USINESS

7/2000

STATE OF HAWAII

DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS

Business Registration Division

1010 Richards Street

Mailing Address: P.O. Box 40, Honolulu, Hawaii 96810

CORRECTION

(Section 415-55.6, 415B-10.6, 425-1.7, 425D-206.6, 428-207, 425-

, Hawaii Revised Statutes)

PLEASE TYPE OR PRINT LEGIBLY IN BLACK INK

Please check one:

Profit Corporation

Nonprofit Corporation

General Partnership

Limited Partnership

LLC

LLP

(F/$50/B14)

(F/$20/B14)

(F/$25/B33, SH/S12)

(F/$20/B34)

(F/$50/L14)

(F/$100/L34)

1.

Name of business entity:

________________________________________________________________________________________

(Corporation, Partnership, LLC Name)

2.

Describe the document to be corrected, including the date the document was filed with the Department of Commerce and

Consumer Affairs, or attach a copy of the document to be corrected.

3.

Specify the incorrect statement and give the reason it is incorrect or describe the manner in which the document was

defectively executed, attested, sealed, verified, or acknowledged.

4.

The incorrect statement or defective execution is corrected as follows or as attached hereto:

5.

For LLC only, attach the entire corrected record.

We certify under the penalties of Section 415-136, 415B-158, 425-13, 425D-204, 425D-1108, Hawaii Uniform Limited Liability

Company Act, and Hawaii Limited Liability Partnership Act, Hawaii Revised Statutes, as applicable, that we have read the

above statements and that the same are true and correct.

Signed this ____________day of ___________________________________, __________

_______________________________________________________

_________________________________________________________

(Type/Print Name & Title)

(Type/Print Name & Title)

_______________________________________________________

_________________________________________________________

(Signature)

(Signature)

SEE INSTRUCTIONS ON REVERSE SIDE. For corporations, document must be signed by two individuals who are officers of the corporation.

General partnerships must be signed by a general partner. Limited partnerships must be signed by all general partners. For LLC, must be

signed and certified by at least one manager of a manager-managed company or by at least one member of a member-managed company.

LLP must be signed and certified by at least one partner.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1