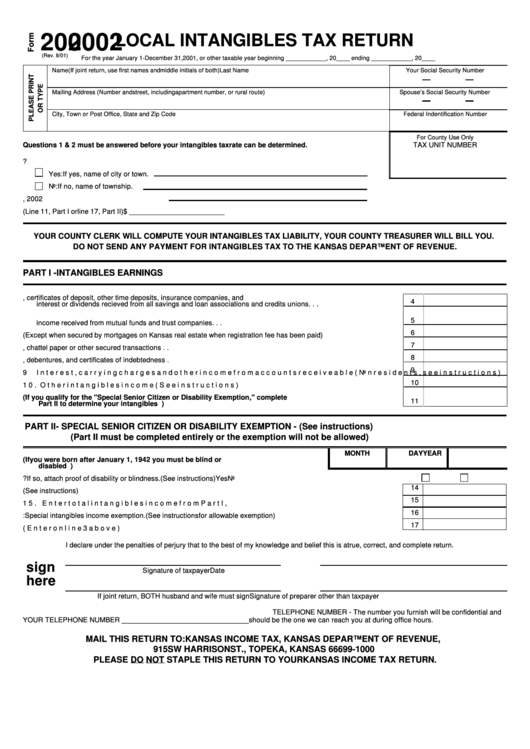

Form 200 - Local Intangibles Tax Return - 2002

ADVERTISEMENT

200

2002

LOCAL INTANGIBLES TAX RETURN

(Rev. 8/01)

For the year January 1-December 31, 2001, or other taxable year beginning ____________, 20____ ending ____________, 20____

Name (If joint return, use first names and middle initials of both)

Last Name

Your Social Security Number

Mailing Address (Number and street, including apartment number, or rural route)

Spouse’s Social Security Number

City, Town or Post Office, State and Zip Code

Federal Indentification Number

For County Use Only

Questions 1 & 2 must be answered before your intangibles tax rate can be determined.

TAX UNIT NUMBER

1. Is your legal residence located within the corporate limits of a city or town?

Yes: If yes, name of city or town.

No:

If no, name of township.

2. County of residence as of January 1, 2002

3. Intangibles Income (Line 11, Part I or line 17, Part II)

$ ________________________

YOUR COUNTY CLERK WILL COMPUTE YOUR INTANGIBLES TAX LIABILITY, YOUR COUNTY TREASURER WILL BILL YOU.

DO NOT SEND ANY PAYMENT FOR INTANGIBLES TAX TO THE KANSAS DEPARTMENT OF REVENUE.

PART I - INTANGIBLES EARNINGS

4.

Interest from bank savings accounts, certificates of deposit, other time deposits, insurance companies, and

4

interest or dividends recieved from all savings and loan associations and credits unions. . . . . . . . . . . . . . . . . . . . . . . .

5.

Dividends or other income from corporation stock including those located in Kansas and dividends or interest

5

income received from mutual funds and trust companies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6.

Interest from notes (Except when secured by mortgages on Kansas real estate when registration fee has been paid)

7

7.

Earnings from conditional sales contracts, chattel paper or other secured transactions . . . . . . . . . . . . . . . . . . . . . . . .

8

8.

Interest or discount income from bonds, debentures, and certificates of indebtedness . . . . . . . . . . . . . . . . . . . . . . . . .

9

9

Interest, carrying charges and other income from accounts receiveable (Nonresidents, see instructions) . . . . . . . . . .

10

10. Other intangibles income (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Total intangibles income (If you qualify for the "Special Senior Citizen or Disability Exemption," complete

11

Part II to determine your intangibles income. Enter on line 3 if you do not qualify for the exemption.) . . . . . .

PART II - SPECIAL SENIOR CITIZEN OR DISABILITY EXEMPTION - (See instructions)

(Part II must be completed entirely or the exemption will not be allowed)

MONTH

DAY

YEAR

12. YOUR DATE OF BIRTH (If you were born after January 1, 1942 you must be blind or

disabled to qualify. See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Is this special exemption based on disability or blindness? If so, attach proof of disability or blindness. (See instructions)

Yes

No

14

14. Total household income for 2001. (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15. Enter total intangibles income from Part I, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16. LESS: Special intangibles income exemption. (See instructions for allowable exemption) . . . . . . . . . . . . . . . . . . . .

17

17. Taxable intangibles income. (Enter on line 3 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare under the penalties of perjury that to the best of my knowledge and belief this is a true, correct, and complete return.

sign

Signature of taxpayer

Date

here

If joint return, BOTH husband and wife must sign

Signature of preparer other than taxpayer

TELEPHONE NUMBER - The number you furnish will be confidential and

YOUR TELEPHONE NUMBER ________________________________

should be the one we can reach you at during office hours.

MAIL THIS RETURN TO: KANSAS INCOME TAX, KANSAS DEPARTMENT OF REVENUE,

915 SW HARRISON ST., TOPEKA, KANSAS 66699-1000

PLEASE DO NOT STAPLE THIS RETURN TO YOUR KANSAS INCOME TAX RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1