Form W-3 -For Employer'S Monthly/quarterly Returns - 2014

ADVERTISEMENT

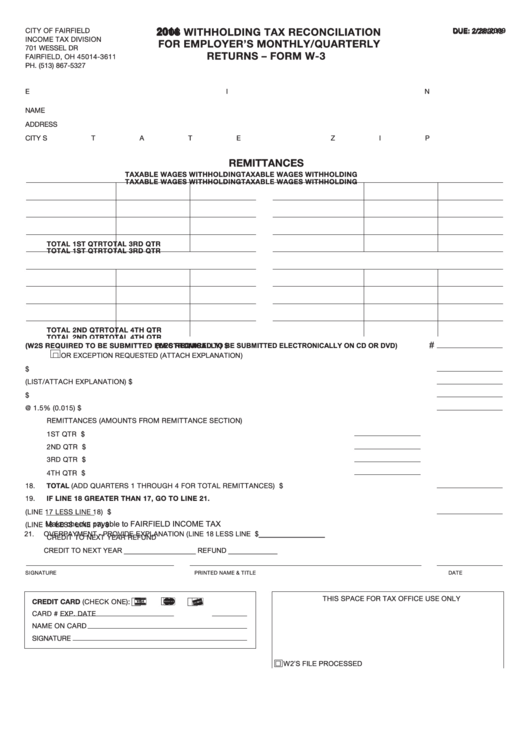

2 14

DUE: 2/27/2015

CITY OF FAIRFIELD

2008 WITHHOLDING TAX RECONCILIATION

DUE: 2/28/2009

INCOME TAX DIVISION

FOR EMPLOYER’S MONTHLY/QUARTERLY

701 WESSEL DR

RETURNS – FORM W-3

FAIRFIELD, OH 45014-3611

PH. (513) 867-5327

EIN#

PHONE NUMBER

NAME

ADDRESS

CITY

STATE

ZIP

REMITTANCES

TAXABLE WAGES

WITHHOLDING

TAXABLE WAGES

WITHHOLDING

TAXABLE WAGES

WITHHOLDING

TAXABLE WAGES

WITHHOLDING

1.

JANUARY

7.

JULY

1.

JANUARY

7.

JULY

2.

FEBRUARY

8.

AUGUST

2.

FEBRUARY

8.

AUGUST

3.

MARCH

9.

SEPTEMBER

3.

MARCH

9.

SEPTEMBER

TOTAL 1ST QTR

TOTAL 3RD QTR

TOTAL 1ST QTR

TOTAL 3RD QTR

4.

APRIL

10.

OCTOBER

4.

APRIL

10.

OCTOBER

5.

MAY

11.

NOVEMBER

5.

MAY

11.

NOVEMBER

6.

JUNE

12.

DECEMBER

6.

JUNE

12.

DECEMBER

TOTAL 2ND QTR

TOTAL 4TH QTR

#

TOTAL 2ND QTR

TOTAL 4TH QTR

13.

TOTAL NUMBER OF EMPLOYEES (W2S REQUIRED TO BE SUBMITTED ELECTRONICALLY) .......................................

$

14.

TOTAL PAYROLL FOR THE YEAR ............................................................................................................................................

$

15.

LESS PAYROLL NOT SUBJECT TO TAX (LIST/ATTACH EXPLANATION) ................................................................................

$

16.

PAYROLL SUBJECT TO THE TAX ............................................................................................................................................

$

17.

WITHHOLDING TAX LIABILITY @ 1.5% (0.015) .......................................................................................................................

$

REMITTANCES (AMOUNTS FROM REMITTANCE SECTION)

1ST QTR ........................................................................................................................................

$

2ND QTR .......................................................................................................................................

$

3RD QTR .......................................................................................................................................

$

4TH QTR ........................................................................................................................................

$

18.

TOTAL (ADD QUARTERS 1 THROUGH 4 FOR TOTAL REMITTANCES) ................................................................................

$

19.

IF LINE 18 GREATER THAN 17, GO TO LINE 21.

20.

BALANCE DUE (LINE 17 LESS LINE 18) .................................................................................................................................

$

Make checks payable to FAIRFIELD INCOME TAX

21.

21.

OVERPAYMENT - PROVIDE EXPLANATION (LINE 18 LESS LINE 17.....................................................................................

OVERPAYMENT - PROVIDE EXPLANATION (LINE 18 LESS LINE 17).....................................................................................

$ _________________

$

CREDIT TO NEXT YEAR

REFUND

CREDIT TO NEXT YEAR ___________________ REFUND _____________

SIGNATURE

PRINTED NAME & TITLE

DATE

THIS SPACE FOR TAX OFFICE USE ONLY

i

[

r

CREDIT CARD (CHECK ONE):

CARD #

EXP. DATE

NAME ON CARD

SIGNATURE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2