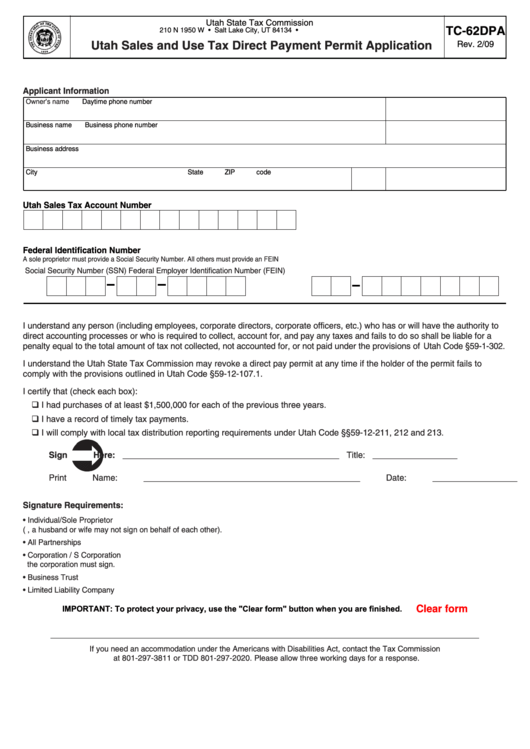

Utah State Tax Commission

TC-62DPA

210 N 1950 W • Salt Lake City, UT 84134 •

Utah Sales and Use Tax Direct Payment Permit Application

Rev. 2/09

Applicant Information

Owner’s name

Daytime phone number

Business name

Business phone number

Business address

City

State

ZIP code

Utah Sales Tax Account Number

Federal Identification Number

A sole proprietor must provide a Social Security Number. All others must provide an FEIN

Social Security Number (SSN)

Federal Employer Identification Number (FEIN)

I understand any person (including employees, corporate directors, corporate officers, etc.) who has or will have the authority to

direct accounting processes or who is required to collect, account for, and pay any taxes and fails to do so shall be liable for a

penalty equal to the total amount of tax not collected, not accounted for, or not paid under the provisions of Utah Code §59-1-302.

I understand the Utah State Tax Commission may revoke a direct pay permit at any time if the holder of the permit fails to

comply with the provisions outlined in Utah Code §59-12-107.1.

I certify that (check each box):

I had purchases of at least $1,500,000 for each of the previous three years.

I have a record of timely tax payments.

I will comply with local tax distribution reporting requirements under Utah Code §§59-12-211, 212 and 213.

Sign Here: ______________________________________________

Title: __________________

Print Name: ______________________________________________

Date: __________________

Signature Requirements:

• Individual/Sole Proprietor .............................................................. Signature must match SSN provided above

(e.g., a husband or wife may not sign on behalf of each other).

• All Partnerships ............................................................................ One general partner must sign.

• Corporation / S Corporation ......................................................... An officer of the corporation authorized to sign on behalf of

the corporation must sign.

• Business Trust .............................................................................. The grantor or a trustee must sign.

• Limited Liability Company ............................................................. A member must sign.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission

at 801-297-3811 or TDD 801-297-2020. Please allow three working days for a response.

1

1 2

2