Form De 999a - Offer In Compromise Application

ADVERTISEMENT

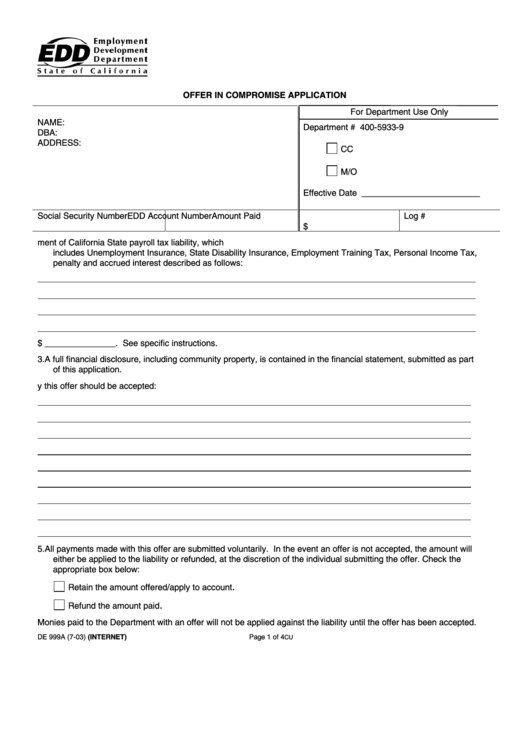

OFFER IN COMPROMISE APPLICATION

For Department Use Only

NAME:

Department # 400-5933-9

DBA:

ADDRESS:

CC

M/O

Effective Date _________________________

Social Security Number

EDD Account Number

Amount Paid

Log #

$

1. The undersigned submits this Offer in Compromise for payment of California State payroll tax liability, which

includes Unemployment Insurance, State Disability Insurance, Employment Training Tax, Personal Income Tax,

penalty and accrued interest described as follows:

2. The total amount of the offer $ _______________. See specific instructions.

3. A full financial disclosure, including community property, is contained in the financial statement, submitted as part

of this application.

4. Explain the facts and reasons why this offer should be accepted:

5. All payments made with this offer are submitted voluntarily. In the event an offer is not accepted, the amount will

either be applied to the liability or refunded, at the discretion of the individual submitting the offer. Check the

appropriate box below:

.

Retain the amount offered/apply to account

.

Refund the amount paid

Monies paid to the Department with an offer will not be applied against the liability until the offer has been accepted.

DE 999A (7-03) (INTERNET)

Page 1 of 4

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2