Form St-394 - Rental Surcharge Return

ADVERTISEMENT

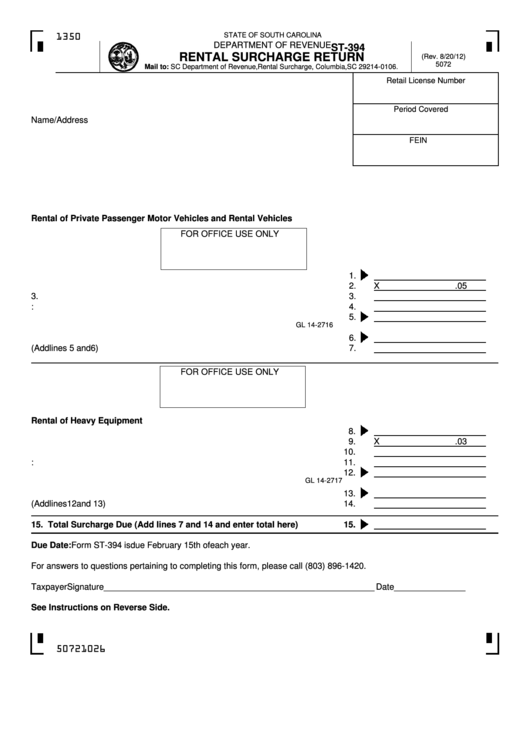

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

ST-394

RENTAL SURCHARGE RETURN

(Rev. 8/20/12)

5072

Mail to: SC Department of Revenue, Rental Surcharge, Columbia, SC 29214-0106.

Retail License Number

Period Covered

Name/Address

FEIN

Rental of Private Passenger Motor Vehicles and Rental Vehicles

FOR OFFICE USE ONLY

1. Total of Rental Agreements .............................................................................

1.

2. Surcharge Rate ................................................................................................

2.

X

.05

3. Surcharge Due .............................................................................................

3.

4. Less: S.C. Property Tax Paid ..........................................................................

4.

5. Net Taxable Due ..............................................................................................

5.

GL 14-2716

6. Penalty __________________________ Interest ______________________

6.

7. Surcharge Amount Due (Add lines 5 and 6) ....................................................

7.

FOR OFFICE USE ONLY

Rental of Heavy Equipment

8. Total of Rental Agreements ...............................................................................

8.

9. Surcharge Rate ...............................................................................................

9.

X

.03

10. Surcharge Due ................................................................................................

10.

11. Less: S.C. Property Tax Paid ..........................................................................

11.

12. Net Taxable Due .............................................................................................

12.

GL 14-2717

13. Penalty __________________________ Interest ______________________

13.

14. Surcharge Amount Due (Add lines 12 and 13) ................................................

14.

15. Total Surcharge Due (Add lines 7 and 14 and enter total here)..................

15.

Due Date: Form ST-394 is due February 15th of each year.

For answers to questions pertaining to completing this form, please call (803) 896-1420.

Taxpayer Signature _________________________________________________________ Date _______________

See Instructions on Reverse Side.

50721026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1