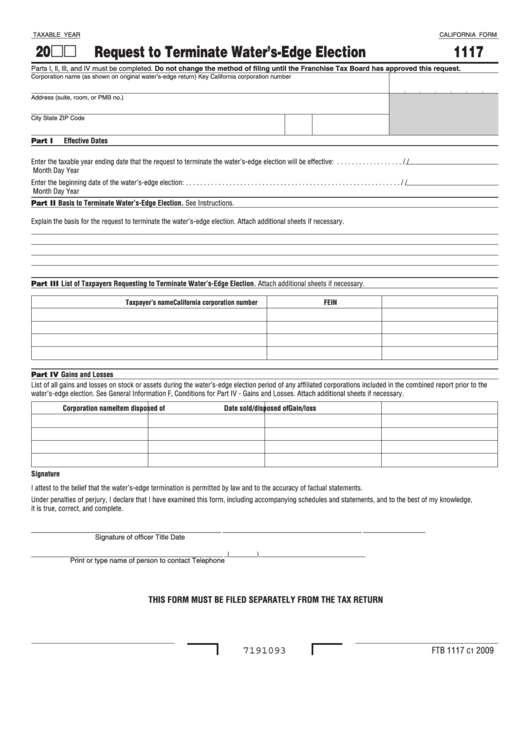

TAXABLE YEAR

CALIFORNIA FORM

20

Request to Terminate Water’s-Edge Election

1117

Parts l, ll, lll, and IV must be completed. Do not change the method of filing until the Franchise Tax Board has approved this request.

Corporation name (as shown on original water’s-edge return)

Key California corporation number

Address (suite, room, or PMB no.)

City

State

ZIP Code

Part I Effective Dates

Enter the taxable year ending date that the request to terminate the water’s-edge election will be effective: . . . . . . . . . . . . . . . . . .

/

/

Month

Day

Year

Enter the beginning date of the water’s-edge election: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

/

/

Month

Day

Year

Part II Basis to Terminate Water’s-Edge Election. See Instructions .

Explain the basis for the request to terminate the water’s-edge election . Attach additional sheets if necessary .

Part III List of Taxpayers Requesting to Terminate Water’s-Edge Election. Attach additional sheets if necessary .

Taxpayer’s name

California corporation number

FEIN

Part IV Gains and Losses

List of all gains and losses on stock or assets during the water’s-edge election period of any affiliated corporations included in the combined report prior to the

water’s-edge election . See General Information F, Conditions for Part IV - Gains and Losses . Attach additional sheets if necessary .

Corporation name

Item disposed of

Date sold/disposed of

Gain/loss

Signature

I attest to the belief that the water’s-edge termination is permitted by law and to the accuracy of factual statements .

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge,

it is true, correct, and complete .

____________________________________________________ ______________________________________ _________________

Signature of officer

Title

Date

_______________________________________________________________ _(_________)___________________________________

Print or type name of person to contact

Telephone

THIS FORM MUST BE FILED SEPARATELY FROM THE TAX RETURN

FTB 1117

2009

7191093

C1

1

1